Generative artificial intelligence (AI) has gained significant attention recently. It's a branch of machine learning that creates new, original, and increasingly human-like content. You've likely heard about it, given its growing prominence in recent months.

Worth mentioning, unlike other forms of AI that focus on analysis or classification, generative AI models create entirely new text, images, audio, video, and other content. Leading examples include conversational chatbots, AI image/video generators, and natural language text generators.

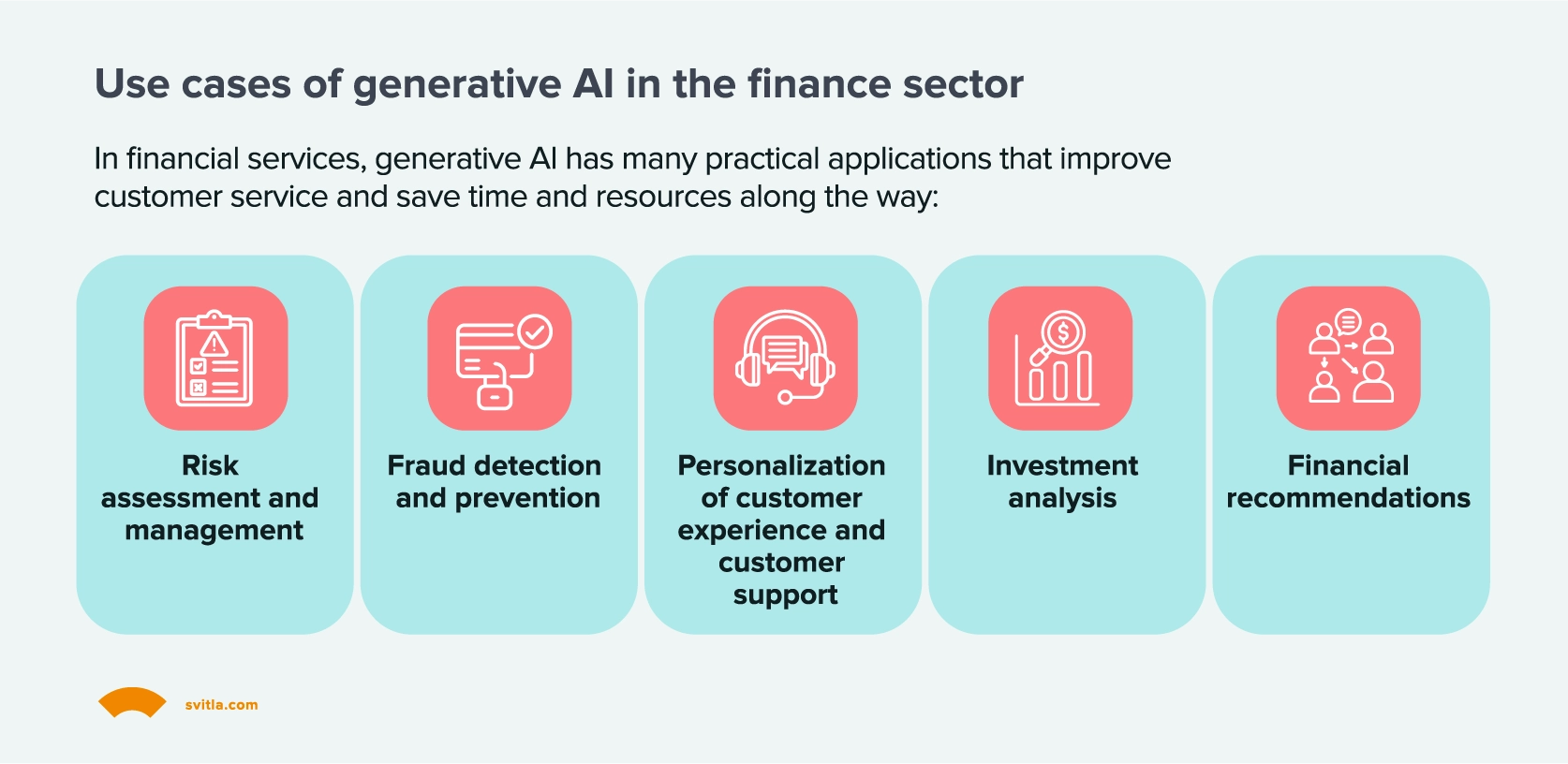

When bringing finance into context, the rise of generative AI is having major implications. As financial institutions implement these technologies, they are automating routine manual processes, gaining deeper insights from data, and providing more personalized service.

However, concerns remain around proper regulation, transparency, and security of generative AI in finance. Models must be carefully audited for fairness, ethics, and accuracy. A successful implementation of generative AI will transform banking, investment advisory, insurance, and other financial services.

Virtually every facet of finance stands to become more efficient, customized, and advanced through the application of generative algorithms and models. In particular, 2024 is projected to see accelerated adoption of generative AI in finance, making it an integral year for its emergence in the sector.

Use cases of generative AI in the finance sector

Risk assessment & management

Generative AI in finance allows financial institutions to better assess and respond to risks. By analyzing vast amounts of market data, news, and regulatory filings, generative algorithms can detect early warning signs of emerging risks.

Models can run simulations to forecast potential impacts under different scenarios. This allows banks and investment firms to optimize their risk management strategies. According to Deloitte, generative AI can enable firms to achieve a 30-50% improvement in predicting risk factors. As the models process more data, they continuously refine their risk assessment capabilities. This will likely significantly transform how major financial players assess and mitigate risk.

Fraud detection and prevention

One major application of generative AI in finance is detecting and preventing fraud. Financial institutions process enormous volumes of transactions daily, making it impossible for humans to effectively monitor all activity and identify signs of fraud.

Algorithms excel in detecting irregularities within transaction data that could signal fraud by analyzing patterns. They learn from historical records of both genuine and fraudulent transactions, pinpointing nuanced indicators of risk that might escape human detection. As financial generative AI progresses, these detection systems evolve, becoming increasingly agile and capable of recognizing fraudulent tactics instantaneously.

According to a report by McKinsey, banks using AI for fraud detection can achieve up to a 30% reduction in false positives compared to rules-based systems. Major financial institutions have already implemented AI fraud detection and have seen significant cost savings. As more look to expand the usage of generative models, fraud prevention is poised to be one of the foremost applications of AI in finance.

Investment analysis

Generative AI for finance is also making investment analysis far more sophisticated, where humans have limited capacity to process all available data that may impact investment decisions. Generative models can synthesize vast datasets, including past performance, financial statements, macroeconomic trends, news events, regulatory changes, and more. This allows the models to detect complex patterns and insights human analysts would likely miss.

Some firms are already using generative algorithms to scan potential investments across thousands of parameters to optimize stock selection. This use of generative AI in investment analysis is projected to grow rapidly. According to a BarclayHedge survey, 56% of hedge fund professionals say they use machine learning and AI to inform their investment processes. As algorithms become more advanced, they are expected to revolutionize Wall Street.

Personalization of customer services and support

Many financial institutions are now leveraging generative AI to provide more personalized customer service. Chatbots and virtual assistants that can engage in natural conversations are being used for customer interactions. With access to individual customer data and activity, they can give tailored product recommendations and advice.

Additionally, call center agents are using AI to analyze customer details and transaction histories during conversations. 61% of consumers expect companies to anticipate their needs and make relevant suggestions. Generative AI for finance helps institutions meet this demand for personalization at scale.

Financial recommendations

Related to personalization, generative models are being used by financial institutions to provide customized recommendations. This includes investment product suggestions tailored to an individual customer's risk appetite, goals, and current holdings. Some robo-advisors are using generative AI to analyze clients' full financial pictures and create tailored portfolios.

Models can also generate personalized savings and budgeting plans based on spending patterns and upcoming financial needs. As generative systems grow more advanced, they are expected to become dominant in automated financial recommendations and advisory services.

Advantages of implementing generative AI in finance

Advantages of implementing generative AI in finance

One of the major benefits of generative AI for finance is enabling process automation in finance. Many bank operations like credit approval, fraud detection, risk assessment, and customer service involve manual processing of documents, applications, transactions, and other data points.

Generative AI for finance can be trained to handle repetitive administrative tasks by ingesting relevant data and making approvals, detections, assessments, and other decisions automatically. This frees up human workers to focus on higher-value analysis and oversight. According to McKinsey, early adopters of AI process automation at large banks were able to free up nearly 100 million working hours annually.

Additionally, generative algorithms excel at discerning complex patterns and relationships in massive financial datasets that human analysts simply cannot grasp. An AI system can synthesize countless data points across markets, asset classes, regulatory filings, current events, and more to detect signals and insights. This enhanced analysis leads to better-informed financial strategies and decisions. A survey by Greenwich Associates says that 41% of asset management firms say AI will be a game-changer within the next 1-2 years.

Generative AI in financial services also allows for vastly improved personalization. With access to individual customer financial data and activity, generative systems can understand preferences and needs to an extent no human advisor could. AI chatbots conduct conversations to learn about a customer before offering tailored product suggestions, financial guidance, and market perspectives unique to that individual. For wealth management clients especially, hyper-personalized service creates immense value.

Lastly, generative AI in financial services can provide the benefit of 24/7 availability to engage with customers and offer continuous advisory. While human finance professionals are limited to business hours, AI chatbots and recommendation engines can interact with customers at any time of day to provide on-demand financial guidance. This perennial availability better matches the always-on nature of finance and investing.

Challenges of generative AI in finance

One major challenge is the lack of clear regulations and governance surrounding generative AI in finance. Government policymakers are still defining appropriate oversight and usage standards. There are concerns about the fairness, accountability, and transparency of AI systems. If models make biased decisions or breach privacy, it can deeply erode public trust. Financial institutions must ensure rigorous audits and ethics reviews of their AI. Until more formal regulations emerge, generative AI remains in an uncertain regulatory gray area.

Additionally, security poses a significant challenge. Financial data is highly sensitive, and generative AI systems ingest tremendous volumes of customer information. Safeguarding the privacy and integrity of this data is critical. However, complex neural network models can be vulnerable to manipulation or adversarial attacks. If an AI system was compromised, it could wrongly approve loans, make reckless trades, or impermissibly share private data. Maintaining continually updated cybersecurity protections on AI systems is essential.

The interpretability of generative AI for finance decisions also remains a key challenge. Highly complex generative algorithms can autonomously make important financial decisions without explainability to human users. If the reasoning behind an AI system's judgment cannot be understood, it raises concerns of fairness and safety. Developing methods to increase transparency into the decision-making of generative models is an important priority for the finance sector.

Lastly, increased automation from generative AI threatens certain financial jobs and roles. Systems taking over manual processes and analysis could displace many employees and redefine workforce needs. According to McKinsey, up to 30% of bank jobs could be lost to automation by 2030. While new roles may emerge, job loss remains a considerable human impact. Financial institutions must strategically manage this transition.

Relevance of generative AI in financial services and future trends

Looking ahead, one major trend will be the rise of hybrid solutions that blend generative AI in financial services with human expertise. As algorithms take over more processes and analysis, the role of finance professionals will evolve to focus more on oversight rather than direct execution. Hybrid models where the strengths of AI automation and human judgment are combined are likely to prevail. A Deloitte survey among financial institutions reveals that 97% believe AI will require humans to rethink, rather than replace, their work.

The finance landscape is also expected to see a proliferation of digital-first banks, investment platforms, and other emerging players with fully integrated generative AI in financial services. Without legacy IT systems to overcome, these digitally native companies can build their customer experience around AI in ways established institutions cannot match initially.

Generative AI in financial services is projected to continue automating a growing proportion of routine and repetitive tasks. While this may displace some human roles, it will increase efficiency and allow financial professionals to focus on higher-level functions. McKinsey analysis shows that about 30% of bank work hours are spent on fully automatable tasks.

Lastly, oversight and governance of generative AI in finance will very likely become tighter and more rigorous. As risks around security, ethics, and workforce impacts grow clearer, policymakers are expected to impose stricter regulations around AI development and usage in financial services. Audits for fairness and transparency will be more standardized. Governance frameworks will aim to maximize the benefits of AI while minimizing harm.

Overall, generative AI has immense relevance for the future of finance. It is primed to be a transformative technology and drive how services are delivered, risks are managed, investments are made, and customers are served.

Generative AI for finance: taking advantage today

The integration of generative AI into the finance sector marks a new era of innovation and efficiency. At Svitla Systems, we understand the transformative potential of this technology and are at the forefront of harnessing its capabilities to revolutionize banking systems.

Whether it's enhancing customer experiences, automating complex financial processes, or ensuring robust security measures, Svitla Systems is equipped to guide your journey into the future of banking. Our global presence across the USA, Canada, Poland, Mexico, and Ukraine positions us uniquely to offer diverse perspectives and comprehensive solutions.

Don't let your firm lag in the rapidly evolving digital landscape. Get in touch with Svitla Systems today, and let's discuss how we can collaboratively navigate the intricacies of generative AI in finance and transform your banking system for the better.