To succeed in investment, your decisions must be based on actionable data rather than gut feeling. This is where predictive analytics comes in handy. A cutting-edge discipline within data science asks, "What could happen next?". It offers insights illuminating the path forward as investors navigate a landscape influenced by many variables. With advanced computational models and algorithms, investors can make data-driven decisions and cut risks based on past and present trends.

This article will delve into predictive analytics in investment management and how it revolutionizes finance strategies. Keep reading to unravel its true potential!

Predictive Analytics in Investment Management

As a branch of data science for business, predictive and advanced analytics growth coincides with the development of big data systems, where larger and broader volumes of data enable enhanced data mining to provide predictive insights. Advances in big data machine learning have also helped expand predictive analytics capabilities.

Predictive analytics uses historical data to anticipate future market trends and potential investment prospects. This analytical approach aids investors and financial analysts make well-informed decisions by examining extensive data derived from diverse sources, including financial statements, economic indicators, market updates, and sentiment analysis from social media.

Predictive analytics models can thoroughly analyze these data sets and recognize patterns, correlations, and emerging trends. Such insights prove instrumental in enabling managers to forecast future market conditions, identify viable investment opportunities, and effectively manage risks.

At first sight, predictive analytics seems similar to data analytics. Yet, these two concepts are pretty different. Let's take a closer look at data analytics. Simply, it is a process characterized by applying filters and transformations to raw data to produce logical sets, patterns, and conclusions.

Find more distinctions between predictive analytics and data analytics in the table below.

| Features | Data Analytics | Predictive Analysis |

| Definition | Inspecting and refining data to conclude from a dataset. | Examining and operating on current and past data trends to infer patterns for making predictions based on them. |

| Goal | Make data-driven decisions. | Risk evaluation and prediction of future outcomes. |

| Approach | Traditional algorithmic and mechanical processes are used to build deep insights into data. | Advanced computational models and algorithms are used for building a forecast or prediction platform. |

| Procedure | Raw data is collected, cleaned, structured, and transformed to derive a data product. | Clean data is used to build a predictive model, which is later deployed and monitored to check progress. |

| Outcome | The outcome is based on customer requirements. It may or may not be predictive. | The outcome is a reliable predictive model generated by testing hypotheses and assumptions. |

Data Sources for Predictive Analytics

Data for predictive analytics comes from different sources. Here are some of the most common ones:

Historical Market Data

Historical data pertains to information accumulated from past events and situations relevant to a particular subject. This includes a diverse array of data generated manually or automatically within an organization. Potential origins of historical data encompass press releases, log files, financial reports, project and product documentation, email correspondence, and various forms of communication.

Within a business context, historical data is a valuable tool for pivotal strategic decision-making concerning the present and future. Managers heavily rely on historical data to oversee and evaluate organizational performance across a period, pinpoint areas necessitating enhancement, and form insightful predictions concerning forthcoming trends.

Economic Indicators

An economic indicator comprises economic data, typically on a macroeconomic scale, that analysts utilize to interpret present or future investment prospects. Additionally, these indicators are used to evaluate an economy's general well-being. While investors can choose various data points as economic indicators, specific data released by governmental and non-profit entities have gained widespread attention. Examples encompass the Consumer Price Index (CPI), gross domestic product (GDP), and unemployment figures.

Like other financial or economic metrics, economic indicators hold significant value when assessed over time. For instance, governments may analyze the fluctuation of unemployment rates over the past five years. Isolated unemployment rate data may not offer substantial insights, but comparing it to previous periods gives analysts a more informed perspective on the statistics.

Sentiment Analysis

Sentiment analysis entails examining text, contextualizing, and extracting subjective information within the source material. Its goal is to aid businesses in grasping the social sentiment surrounding their brand, product, or service, especially by monitoring online dialogues. Nonetheless, the analysis of social media streams is often confined to basic sentiment assessment and simple metric quantification. This approach barely scratches the surface and overlooks valuable insights awaiting discovery.

To harness the full potential, a brand should adopt a more encompassing approach. Recent strides in deep learning have vastly improved the capacity of algorithms to scrutinize text. Employing advanced artificial intelligence techniques enables thorough research, facilitating the uncovering of profound insights.

Predictive Modeling Techniques in the Investment Industry

The most common techniques of predictive analytics in investment banking are decision trees, neural networks, and regression. Let's explore each of them one by one.

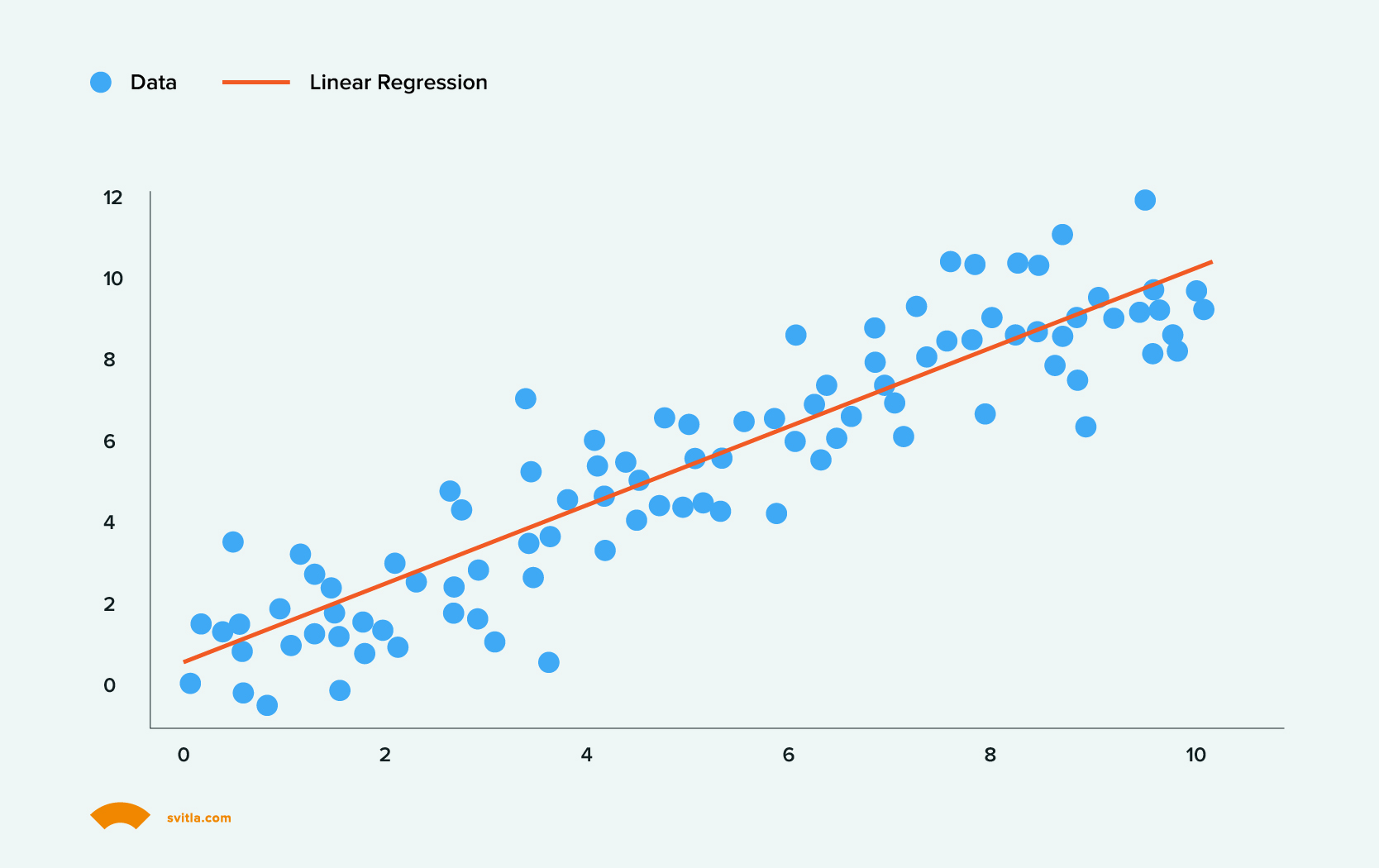

Regression Analysis

Regression is a statistical analysis technique that helps to identify relationships between variables. It is widely used to define patterns in massive datasets or identify the correlation between inputs. Analytics mainly use this method for continuous data that follows a known distribution. Regression is often used to determine how one or more independent variables affect others, such as how a price fluctuation will affect the product's sale.

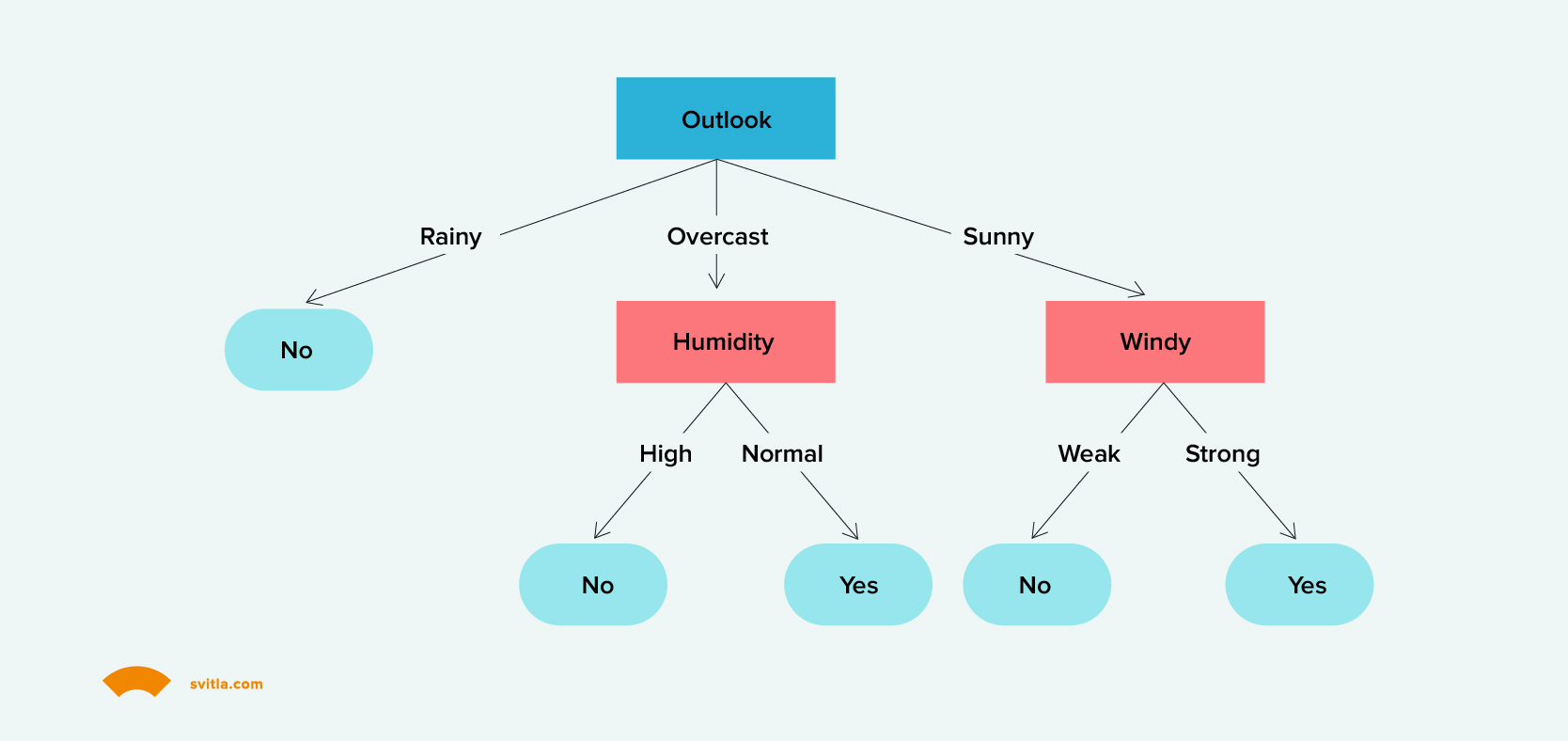

Decision Trees

This classification model places data into different categories based on other variables. It is the best option when you are trying to predict a person's decisions. The model looks like a tree, where each branch is a possible choice, and each leaf is the outcome of the decision. A decision tree is usually easy to understand and works well when several variables are missing from the dataset.

Neural Networks

The neural network is a valuable machine-learning technique. Primarily, it is used for modeling complex relationships. Neural networks are best used to identify nonlinear relationships in data sets, primarily when no known mathematical formula exists for data analysis. Neural networks can validate the results of decision trees and regression models.

.jpg)

Application of Predictive Analytics in Investment Strategies

Almost any business or industry can benefit from predictive analytics in streamlining operations, increasing revenue, and reducing risk like banking, retail, utilities, the public sector, healthcare, and manufacturing. We've listed below just some of the most prominent examples.

.jpg)

Portfolio Management

Portfolio management entails the thoughtful selection and adept oversight of investments designed to align with the extended financial goals of clients, enterprises, or institutions. Predictive analytics assume a vital role in harmonizing assets considering risk, projected returns, and prevailing market dynamics. Employing advanced algorithms, predictive analytics anticipate potential asset prices and estimate probable profits and losses, empowering informed portfolio adjustments grounded in discerning analysis.

Asset Allocation

Asset allocation diversifies an investor's capital between different asset classes to mitigate risks while optimizing potential opportunities. The main asset classes include stocks, bonds, and cash. In addition, it can also include real estate, commodities, and cryptocurrencies.

Predictive analytics in investment banking helps to determine the most efficient asset allocation using predictive models. These models consider market trends, economic indicators, interest rates, inflation, and asset ratios. Investors can allocate their investments among different asset classes to achieve a desired risk and return profile by predicting future asset performance.

Market Timing

Market timing involves strategically redistributing investment funds in the financial market or their movement between asset classes, guided by forecasting methodologies. By accurately predicting market fluctuations, investors can make trades to capitalize on these movements and profit.

Investors use predictive analytics to strategically time market entry and exit. Forecasting models predict potential market trends by analyzing historical market data, sentiment analysis, technical indicators, and external factors such as geopolitical events. Thus, investors can make timely decisions to maximize profits or cut losses.

Risk Management

Risk management is a multifaceted procedure involving the identification, assessment, and proactive management of financial, legal, strategic, and security risks. These risks stem from various sources, such as financial instability, legal obligations, strategic oversights, accidents, and natural disasters, demanding a vigilant and preemptive approach to mitigate their impact effectively.

Advanced models provide forecasts on potential risks linked to individual assets or entire portfolios. Predictive analytics encompasses the evaluation of volatility, downside potential, credit risks, and other pertinent risk factors. Leveraging these forecasts enables strategic modifications to portfolios and exposures, aiding in the prevention of potential losses.

Benefits of Predictive Analytics in Investments

An organization with foresight based on historical patterns has a distinct business advantage in effectively managing inventories, workforce, marketing campaigns, and other facets of operation.

Data Security

Every organization places a high priority on data protection, which can be enhanced by using a combination of automation and predictive analytics. It is possible to activate designated security protocols in response to specific patterns associated with suspicious and atypical user behavior.

Risk Mitigation

Besides ensuring data security, most businesses strive to diminish their risk profiles. For instance, a company that extends credit can employ data analytics to better understand whether a customer presents an above-average risk of default. Other companies may utilize predictive analytics to assess the sufficiency of their insurance coverage.

Operational Effectiveness

More streamlined workflows result in enhanced profit margins. For instance, being aware of when a fleet delivery vehicle will require maintenance before its breakdown on the roadside enables timely deliveries without incurring the additional expenses of towing the car and assigning another employee to complete the delivery.

Enhanced Decision-Making

Any expansion or addition to a product line and other growth forms entails balancing inherent risk and potential outcomes. Predictive analytics can provide valuable insights for decision-making and confer a competitive edge.

Limitations of Predictive Analytics in Investments

While predictive analytics has many benefits, there are also some limitations you should be aware of:

- Lack of transparency.Predictive analytics is challenging to understand, which may lead to a lack of transparency and reliability in decision-making. Therefore, you can face problems with the clients' trust and confidence in your company.

- Privacy and ethical concerns. A predictive analytics model may rely on personal information and financial records. Consequently, investment managers using this strategy must comply with all relevant regulations and ethical guidelines.

- Mandatory skills and expertise. Performing predictive analytics requires solid skills in machine learning, data analysis, and statistics. Thus, to benefit from this approach, you should either invest in your current staff's education or hire employees with the appropriate expertise.

To Conclude

Predictive analytics encompasses the advanced algorithms and models that help to assess historical data and foresee future market trends. Through an in-depth analysis of extensive historical price and volume data, this tool provides valuable insights into potential market behavior and the ability to predict forthcoming price fluctuations with a certain degree of precision.

It's essential to emphasize that while predictive analytics can be used for many goals, including portfolio management or asset allocation, it also has certain limitations. The most common ones you can meet are lack of transparency, privacy concerns, and required skills in machine learning, data analysis, and statistics.

Do you want to be ahead of the race? Svitla Systems is here to help you. Contact us to implement predictive analytics tools in your business processes!