Since the start of this decade, the fintech market has been going strong. About 360 companies became unicorns and 8 IPOed in 2024, including Digit Insurance, Aasaan Loans, and MobiKwik.

The funding drought is also ending, with fintech investment rates climbing by 10% in Europe, mostly due to early-stage funding. LatAm saw a record 71.4% YoY growth in funding in 2024. The median fintech deal size increased to $4M globally, signaling renewed investor confidence in high-growth fintech apps.

Learn about the most promising opportunities from fintech application development across the fastest-growing market segments.

Main Types of Fintech Apps

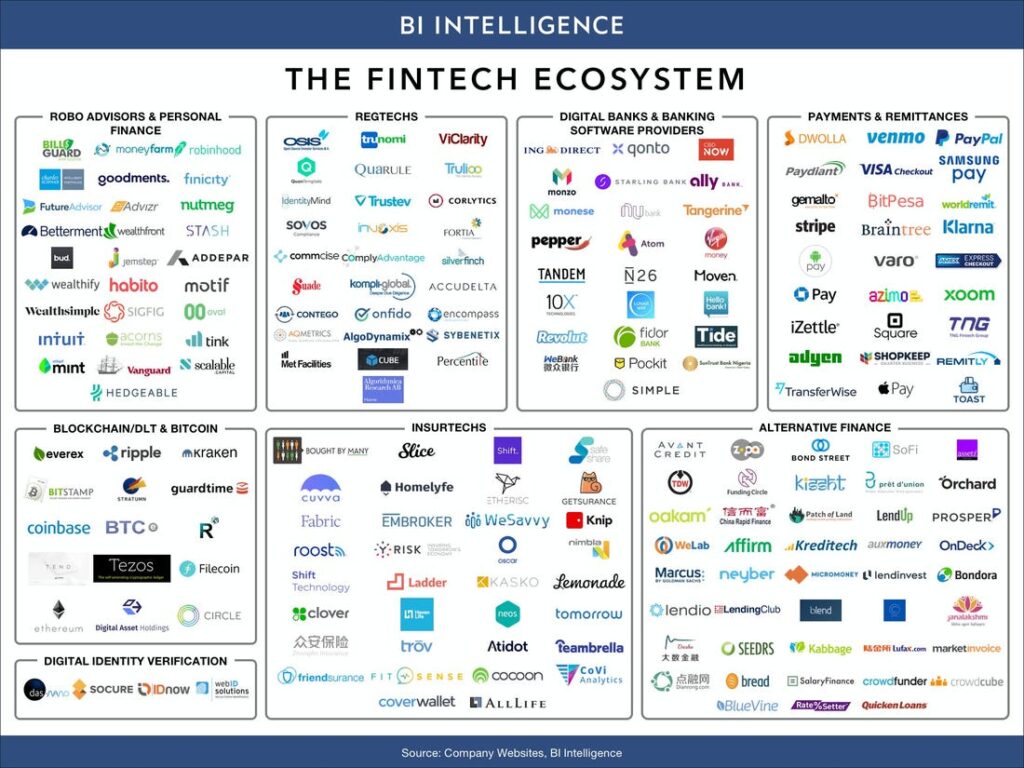

The flourishing fintech ecosystem, valued at $228.24 billion today, includes digital-native banks, online payment companies, personal finance management, wealth management, and Insurtech. There’s also a growing segment of FinTech ‘infrastructure’ companies offering solutions for BaaS, risk management, compliance, and fraud prevention.

By strategically leveraging digital channels and emerging technologies, the FinTech market is expected to grow to $1.5 trillion in revenue by 2030 – a growth of roughly five times from today.

Below are the main market opportunities we see for further fintech application development across its six key segments.

Digital Banking Apps

Digital challenger banks (neobanks) emerged in the early 2010s. NYC-based Simple Bank (now merged with BBVA USA) was the first to offer fully online services in 2009, followed by unicorns like Revolut, Monzo, and N26 cropping up several years later.

The value prop of digital banks was blissfully simple: no fees, mobile checking accounts, and low-cost cross-border transfers. That caught consumers’ attention as traditional banks struggled with UX and charged hefty fees.

Today, there are over 300 digital banks worldwide (72 in the US, 59 in the UK, and 58 in France). Nearly 60% of the top 100 digital banks are profitable, and the biggest players are posting impressive profits. Revolut revenues surpassed $2.2 billion and profits reached a record $545 million in 2023. Brazilian Nubank reported $2.9 billion in revenue and a net income of $553 million in Q3 2024. Publicly traded US Ally Bank closed the year with $8.2 billion in net revenue and $836 million in pre-tax income.

Today, there are over 300 digital banks worldwide (72 in the US, 59 in the UK, and 58 in France). Nearly 60% of the top 100 digital banks are profitable, and the biggest players are posting impressive profits. Revolut revenues surpassed $2.2 billion and profits reached a record $545 million in 2023. Brazilian Nubank reported $2.9 billion in revenue and a net income of $553 million in Q3 2024. Publicly traded US Ally Bank closed the year with $8.2 billion in net revenue and $836 million in pre-tax income.

Global markets still have untapped segments for new fintech mobile app development. Banking services penetration rates are 50% across Southeast Asia (30% in some countries) and 30% in LatAm. The digital banking scene is developing in the Middle East and Africa (MEA), with UAE, a country with $3.2 trillion in banking assets, investing in the local FinTech ecosystem.

Analysts expect a strong 2025 for this FinTech segment. Accenture anticipates a greater focus on seamless customer experience powered by generative AI. The best digital banks will reduce users’ cognitive load and simplify financial tasks through big data analytics systems at the back and AI-powered conversational interfaces at the front. With fine-tuned LLMs, online banking can become even more intuitive, rapid, and delightful, helping challengers grow and engage their audiences.

Learn more about building a competitive digital banking application.

Key Players

- 🌍Revolut

- 🇬🇧 Monzo

- 🇪🇺N26

- 🇧🇷Nubank

- 🇺🇸Chime

- 🇺🇸Ally Financial

- 🇰🇷KakaoBank

- 🇩🇪Vivid Money

Personal Finance Apps

Despite abundant information, only about half of US adults are financially literate. The situation is similar worldwide. Around 14.1 million Brits struggle with budgeting or overspending. Almost a third of Europeans admit to living in a financially precarious situation.

In other words — there’s still high demand for personal finance management (PFM) solutions and a ripe opportunity for fintech application development.

The personal finance app industry grew to $133 billion in 2024 and set a 25% CAGR until 2028. With Open Banking adoption in the EU and UK, non-financial companies can access consumers’ data (with permission) to provide a full picture of their financial health.

Predictive analytics and machine learning, in turn, enable accurate analytics into users’ income, spending, and savings habits, alongside personalized coaching-style recommendations. British PFM app Cleo, known for its sassy personality, uses AI algorithms to create personalized money management plans and coach users to improve using the iconic “Roast” and “Hype” modes. The app hit an impressive $150m ARR last year.

Others like Rocket Money (former Truebill) amassed a loyal user base by helping them cut unnecessary subscriptions, consolidate bills, and maintain sufficient balance for upcoming debits.

Another interesting segment in this FinTech niche is on-demand pay startups, offering workers early access to wages or spotting small sums until payday. It’s a strong business model because it can work for almost every sector, has lower risks, and higher adoption rates as some 34% of workers want this option. Spanish on-demand pay startup Payflow proves that. Founded in 2020, the five-year startup generates over €4 million in ARR, while expanding in new Spanish-speaking markets in LatAm.

Learn more about the nitty-gritty of personal finance app development.

Key Players

- 🇬🇧Cleo

- 🇺🇸Rain

- 🇺🇸Dave

- 🇫🇷Bankin’

- 🇺🇸Propel

- 🇺🇸Rocket Money

- 🇮🇳Koshex

Online Payment and Remittance Apps

Digital payments is arguably one of the largest segments of the fintech app ecosystem, featuring payment processors, acquires, orchestration platforms, buy now, pay later (BNPL) services, and cross-border payment providers.

Following the massive rise in digital payment volumes, the Payment niche also continues to attract nearly 3X more funding than any other sub-segment. The money transfer and remittance market, in particular, has a strong upward trajectory and is expected to reach $428 billion in 2025.

Startups like Wise (former TransferWise) have proved the opportunity size. The company launched as a low-fee cross-border money transfer app but evolved into a financial platform, combining personal and business banking services. Over the last year, Wise moved over £118.5 billion in assets, while also driving steady adoption rates of its banking services. The company’s underlying income increased by 31% YoY to £1.2bn in 2024.

UK remittance player Paysend also had a strong year, expanding its market share through partnerships with Mastercard (to launch a service in Mexico) and United Payments (for a new product in Georgia). The company expanded its enterprise customer outreach, enticing global cross-border payroll companies with compliant and low-cost single API solutions for sending money to accounts, cards, and wallets in 192 countries.

In general, the digital payments market is poised for another prime year and exceptional profitability. Capgemini expects more “multi-territory, instant payment corridors” to emerge through 2025, driven by initiatives such as the US-EU financial corridor, BIS Project Nexus, and wider adoption of the ISO 2022 enhanced payment rail interoperability standard.

Learn more about developing a money transfer application.

Key Players

- 🌎Stripe

- 🌍Wise

- 🇮🇳Razorpay

- 🌏 Xendit

- 🇪🇺GoCardless

- 🇪🇺Adyen

- 🌎Square

- 🌍TransferGo

- 🇪🇺Paysend

Investment and Trading Apps

With the rise of more advanced data analytics techniques for investing, the wealth management and robo-advisory markets are gaining renewed momentum. Global funding for WealthTech startups is up to $1.75 billion in 2024, from $0.66 billion a year before

Micro-investing and trading apps are also seeing regional spikes in adoption as more retail investors dab in buying fractional shares, especially in emerging economies. One in three financial advisors in the Middle East expects the number of digital-only investing solutions to increase dramatically in 2025. UAE-based investment platform Sarwa posted a 124% revenue growth in Q1 2024, following a jump in adoption rates. Trading volumes also surpassed 10 billion AED for the first time.

Further East in India, the wealthtech space attracted over $228 million in investments last year. With an estimated 1 million high net worth individuals (HNWI), it remains a large, mostly untapped market for investment products.

Back in the Western hemisphere, American investing apps also had a strong year. The local titan SoFi reported a 74% YoY net revenue increase and its fifth consecutive quarter of GAAP profitability. Robo-investing app Robinhood grew its revenue by 36% YoY to $637 million, marking the second-highest quarterly revenue in the company’s history.

Investing and wealth management niche generates higher annual revenue per user (ARPU) of about $18k, lending to strong profit margins. There’s also room for new entrants. The European wealth management market is dominated by UK firms, but post-Brexit regulations are more challenging. There’s strong demand among local consumers for US-styled platforms offering one-stop-shop access to financial tools for retirement planning, active and passive investing, and debt management.

New FinTechs can carve their niche in the $400B HNWI, currently dominated by incumbent players, through asset tokenization. Asset tokenization involves creating a digital equivalent (token) of a physical (e.g., a painting) or digital asset (e.g., company equity). Effectively, it allows affluent retail investors to access a new market of alternative asset classes — high-end cars, jewelry, and art — through fractional ownership. Demand is high: 35% of Millennial investors want more alternatives but lack the tools.

In 2024, over $176 billion worth of tokenized assets were locked on different chains. In 2025, the number may increase by another $50 billion. On January 9, 2025, the OECD also published a new policy paper about asset tokenization in financial markets, showcasing central banks and financial institutions' experiments with this technology. Countries like Slovenia, Germany, and Switzerland show high institutional openness to the idea. It could be an interesting niche to explore in 2025.

Key Players

- 🇺🇸Acorns

- 🇺🇸SoFI

- 🇺🇸Betterment

- 🌎Robinhood

- 🇪🇺Trade Republic

- 🇬🇧Freetrade

- 🌎Interactive Brokers

- 🇮🇳Groww

- 🇺🇸Stash

- 🇪🇺Bunq

Online Lending Apps

As the cost of living skyrocketed in many countries after prolonged inflation, more consumers are considering fintech lending apps over traditional options like credit cards and consumer loans.

Pure-play online lenders maintained better premiums than traditional FIs by reducing loan underwriting costs with technology. They’re also using machine learning for credit scoring to provide faster approvals and reduce operational risks. Ant Group (former Ant Financials) was among the first to use alternative data (utility payments, mobile data, etc) for loan underwriting, commoditizing access to a wider consumer segment. In two years, microlending accounted for 39.4% of its revenue. Over 80% of users were first-time borrowers. In 2024, Ant Group took its lending business internationally through a new embedded finance lending tool for SMEs.

In the US, Upstart adopted a similar approach. In 2014, the company launched an AI-powered model, using non-traditional variables like education and employment to predict borrowers’ creditworthiness. After a successful IPO in 2020, Upstart has been steadily growing its revenue. In Q3 2024, the company originated over 188K loans, totaling $1.6 billion. The conversion rate on requests was 16.3% and the total revenue stood at $162 million, up by 20% from Q3 2023.

The global microfinance market is expected to grow at a CAGR of 11.3% and reach $330.98 billion by 2028, which is a core specialty of our fintech mobile app development services. Our team helped a US company refactor its legacy SaaS lending platform for better security and maintainability. We developed a new customer portal with a sleek UX, reducing friction points in the lending process. We also implemented a framework that simplifies launching new product launches and new vendor onboarding.

Buy now, pay later (BNPL) is another trend, going strong for several years. Half of US consumers prefer BNPL to credit cards and 62% trust BNPL providers more. In Europe,

According to BNP Paribas, 68% used installment or deferred payments over the last year. Italy and the Netherlands had the highest adoption growth at +14% and +11%, respectively.

In 2025, BNPL providers will likely move into new verticals like housing, utilities, education, and travel as consumers feel ongoing inflationary pressures. MENA-based Tabby allows subscription users to use installments for groceries, utilities, fuel, and food delivery. Dubai-based PostPay offers installment payments of tuition fees.

Yet, the growing adoption of BNPL has raised regulatory concerns. The sleek POS lending experience has increased consumer indebtment. The UK government issued new BNPL consumer protection rules in 2024. The US Consumer Financial Protection Bureau also seeks to put extra "guardrails." So, it’s vital to ensure your product stays compliant and avoids preparatory practices.

Key Players

- 🇺🇸MoneyLion

- 🇺🇸Current

- 🇺🇸LendingClub

- 🇮🇪Wayflyer

- 🇨🇳Lufax

- 🇨🇳Ant Group

- 🇬🇧Zopa

Insurtech Apps

Insurtech companies round out the top fintech apps. Conversely, the insurance market was one of the last to undergo digital transformations as incumbents preferred the status quo. Yet, a slew of digital-first entrants like Lemonade, Kin Insurance, and Root have challenged incumbents' market share.

In 2024, the Insurtech market expanded to $27.8 billion and is now expected to reach $239.2 billion by 2033. Analysts expect growth from AI and gen AI adoption in workflows, embedded insurance deals, and businesses adopting a managing general agents (MGA) model.

Traditionally, customer acquisition cost (CAC) in the insurance industry was $487 to $900 per new account, due to the complex supply side with multiple branches, agents, and distribution partners. In contrast, direct insurers have up to 70% lower operating cost ratios.

Embedded insurance products can help new companies acquire customers at a lower cost, while also strategically expanding their market share through partnerships.

More and more non-insurance businesses (e.g., automotive, manufacturing, and mobility) are looking to offer complementary products through digital channels. Tesla launched its embedded insurance product in several markets and has since issued over $497 million in written premiums. Uber partnered with INSHUR to offer flexible driver policies directly from their platform.

Ongoing talks about Open Insurance in Europe could change data accessibility in the industry, allowing greater transparency and integration between stakeholders. Open standards and APIs could further accelerate the sector’s growth in 2025 and onward.

Get the full scoop on the insuretech software market.

Key Players

- 🇺🇸Ladder

- 🇺🇸Lemonade

- 🇪🇺WeFox

- 🇫🇷Alan

- 🇬🇧Tractable

- 🌎Shift

- 🇺🇸Socotra

Building a Fintech App in 2025? Key Tech Trends to Consider

Here are three top trends to inform your product development roadmap if you’re looking into further fintech application development this year.

Embedded Finance Will Gain Further Traction

BNPL has fueled the surge of embedded finance solutions, showing how financial experiences can be seamlessly brought into other products. However, it’s just the tip of the iceberg. There are still plenty of verticals, where payment experience remains fragmented and money – lost to multiple intermediaries.

We see further significant opportunities in developing embedded finance products for the transportation sector. For example, embedded ticketing solutions for public transport, shipper and freight payments, MaaS applications, toll turnpikes, and e-vehicle charging stations. Similarly, telecom companies could capitalize on B2B IoT billing solutions, P2P payments via text, and QR payment processing. Similarly, 33% of payment facilitators and 9.7% of independent software vendors have a strong interest in embedded finance solutions, according to PYMNTS.

Think about the most relevant, unaddressed customer touchpoints across various journeys and interfaces. There are likely opportunities there to address with embedded solutions.

Conversational Banking to Take Off in 2025

Banks and fintech companies continue to compete on exceptional customer experience. They’re working to minimize friction, simplify tasks, and humanize interactions across a variety of digital touchpoints. And so emerged one of the most promising generative AI use cases in the finance sector – conversational interfaces.

In 2025, we expect more companies to spend on improving their in-app assistants’ ability to understand natural language, offer contextual assistance, and personalized financial management tips. This is made possible by recent advances in retrieval augmented generation (RAG) and knowledge graphs, enabling fast and cost-effective fine-tuning of general LLMs for specific use cases.

Emerging agentic AI also enables smarter next-best-action recommendations. Similar to generative AI, agentic AI assistants have LLMs in their core. The difference is that while generative chat creates content, agentic AI uses LLMs to understand context, make decisions, and take "agent" actions in the real world. This enables a host of new opportunities for financial companies – real-time savings optimization, adaptive tax planning, faster compliance checks, and autonomous transaction processing – according to Citibank.

Push Toward IoT Payments

The combination of 5G and AI has created the perfect momentum for IoT payments to finally skyrocket. Accenture expects a progressive shift from card and phone-based payments to

wearables and biometrics. Wearable payments in Canada have increased by 32% in volume and 34% in value over the last year. Globally, the wearable payment device market is expected to grow to $297.9 billion by 2033.

Similarly, machine-to-machine (M2M) payment solutions are also on the rise, with new solutions capable of executing autonomous payments on users’ behalf. An ING spin-off, FINN-Banking of Things, has been piloting the technology with the NS, the public transportation system in the Netherlands, and BMW. Vodafone JV, and Mastercard, in turn, are working on an M2M autonomous payments system for the UK and European logistics industry.

Overall, plenty of largely untapped opportunities remain for fintech application development – and Svitla Systems would be delighted to advise you in this area. Our financial software development team has substantial experience with launching and modernizing banking software, payment gateways, lending, and investment products for web and mobile. Contact us for a consultation.