Insurance, known for veteran brands and a cautious approach to risk, has finally entered the technology-driven transformation race. We call this insurance transformation race “Insurtech.”

Over 85% of Insurance leaders agree that investment in innovation (products, services, business models) will happen faster than in the last decade, driven by shifting consumer demand and competition from the Insurtech market. The market is ready to reinvent rule-based analytical systems and replace numerous tedious and costly manual workflows with intelligent solutions powered by big data analytics, AI, and cloud technologies.

In this post, we look at the key Insurtech industry trends from the perspective of new digital entrants and established, multi-national carriers.

State of Play in the Insurtech Market

Insurance is a multi-trillion dollar global market, with the US as of 2022 accounting for 43.7% of the global market share by nominal premium volumes, followed by China, the UK, Japan, and France.

Insurtech, a technology-led market subsegment, represents a $7 trillion opportunity, according to Dealroom. InsurTech is twice the size of the FinTech market, which within its own market sector received 10X more funding last year than the previous year.

The insurance sector was slow to digitize as incumbents remained unchallenged. However, the tables are turning, especially in niches like property and casualty (P&C) and life & health insurance (L&H).

Today, 34 Insurtech companies are unicorns (valued at above $1 billion), including publicly-traded digital full-stack insurers Lemonade, Root, and Metromile, and Insurtech infrastructure companies like bolttech, Accelerant, and Quantexa.

Some Insurtech companies compete with incumbent insurers, while others partner with them. Insurtech infrastructure partners have made deals with industry leaders to provide new capabilities for claims management, underwriting, risk management, and digital product distribution.

There's also a third category of Insurtech companies that operate in various domains, including data and analytics partnerships, technology integration, and collaborative distribution channels. This group recognizes the opportunity for disruption and competition within the insurance industry and collaboration with established firms. Using this hybrid approach, they can navigate the complexity of the insurance ecosystem and drive innovation and growth simultaneously.

Zurich Insurance Group partnered with embedded insurance startup, Qover last year. AXA collaborates with Boxx on new cybersecurity insurance products, while Allianz chose bolttech as its embedded partner for APAC and the US.

New players enter the Insurtech industry every year. In the US, new Insurtech companies secured over $533.7 million in funding last year, according to the Forward 50 Americas report by Insurtech Connect. B2B Insurtech solutions make up 48% of the list, followed by B2B2C companies at 32%. P&C insurance technology solutions make up 88% of the rating, followed by L&H and multi-vertical companies. P&C Insurtech innovation includes startups specializing in worker benefits, parametric MGA for logistics, and AI-powered risk monitoring and analysis for commercial properties.

Europe's Insurtech ecosystem is expanding rapidly. Although currently valued lower than its North American counterparts, the European Insurtech industry can become a €200 billion market by 2030, according to McKinsey. B2C Insurtech services providers like WeFox, Luko, and INZMO already account for 10% of the P&C market, holding over $4 billion in annual premiums.

B2B Insurtech enables incumbent players to upgrade their value chains with digital capabilities.Descartes Underwriting supplies brokers with high-fidelity climate data and risk modeling engines for parametric insurance products.Shift Technology combines AI and Insurtech for underwriting, claims management, and financial fraud detection.

New insurance technology trends – generative AI, predictive risk modeling, and Big Data analytics – drive further innovation within the industry.

Key Insurtech Trends for 2024

Just like in any other sector, digital technologies can drive efficiency gains. Insurers can improve loss ratios by 3-8% and achieve 10–20% cost savings across the value chain by using data analytics, according to Swiss Re.

Digitization unlocks new distribution models and untapped revenue, especially through collaboration: 80% of insurance leaders say that collaboration (co-creation, partnership, acquisition) with Insurtech companies is a primary source of innovation.

In practice, this translates to the following trends in Insurtech and the insurance market:

Intelligent Automation for Claims Processing

The insurance industry was among the first to adopt robotic process automation (RPA) — software bots for data entry, validation, and reconciliation. RPA works well with standardized data and simple workflows but struggles with tasks like data extraction from images, qualitative data comparisons, or analysis.

To automate more claims management steps, insurance leaders are considering intelligent automation (IA) solutions, powered by machine learning models. Advanced algorithms can process various data formats (including images, videos, and unstructured data) to provide human specialists with more data for decision-making. Predictive models can also perform effective claims triage and evaluate each claim for validity and accuracy to minimize fraud.

Automation can reduce the cost of a claim’s journey by 30%, leading to faster processing times and substantial cost savings. Generali, a global insurer serving 68 million customers, saved over €80 million by adopting an intelligent Insurtech solution across 25 of its entities. The company relies on optical character recognition (OCR), natural language processing (NLP), and AI algorithms to process incoming claims. Their virtual robot extracts and validates content from the various forms and suggests the next steps for the employee to participate and complete.

AXA advanced its Insurtech software development, launching a digital claims solution for motor insurance customers. AXA's Direct Motor customers can submit and track a claim online. AXA simplified the claim’s journey by integrating its Guidewire Claims System with machine learning models, decision tools, and direct interaction with key suppliers. For simple cases, from customer submission to partners arranging repair — the entire process now takes minutes instead of what used to take hours or even days.

Underwriting, Driven By New Big Data Sources

Insurers have unprecedented access to high-fidelity big data from vehicle telemetry systems, healthcare wearables, 3D asset assessments captured by drones, and geospatial data from satellites.

For example, Insurtech startup Roost provides customers with hardware (sensors, detectors, smart home appliances) to monitor insured premises and provide real-time data on the assets’ state. American National, Aviva, Nodak, and USAA among other customers use data from Rooster to propose more personalized policies.

Zego's business model is rooted in vehicle telematics data. The unicorn startup offers flexible, pay-as-you-drive (PAYD) policies for self-employed drivers. Users can install the Zego Sense app for lower premiums. The app uses vehicle data to calculate a custom score for each driver, rewarding good behavior with lower rates. The company is one of the biggest insurance providers for mobility companies and reported $170.2 million in revenue last year.

New data sources improve risk selection, competitive pricing, and product benchmarking. Machine learning and big data analytics process data faster and build advanced predictive models for Insurtech software solutions.

Predictive Risk Modeling

The insurance industry has a long history with analytics systems. First came jet-casing or clear-casing systems, the rules-based underwriting engines. Such rules-based engines, still in use across many incumbents, allow customization and internal data ingestion. However, each integration required an IT department intervention, limiting the speed and scale of policy personalization.

The latest wave of digital transformations in the sector brought more scalable analytics engines, self-service data querying tools, visualization dashboards, and auto-generated reports. Analysts can add custom rules without coding expertise. However, most analytics solutions are limited to descriptive and diagnostic analytics.

AI and machine learning can help insurers identify irrelevant or redundant data points in the application workflow and process applications immediately to improve customer satisfaction.

Advanced risk profiles can reduce or eliminate questions without impacting the insurer's risk levels. Digital insurer Lemonade has a fast and friendly account opening process powered by predictive analytics models.

Source: Nanotrends

According to Lemonade’s CEO, Daniel Schreiber, “Our integrated array of AI is able to predict churn, cross-sells, and claims with what we believe is unprecedented precision." The company reported lowering its loss ratio in Q3 2023 by 11 percentage points to 83% and growing its gross earned premium per customer by 274% between Q4 2020 and Q3 2023.

Insurtech startups embraced predictive AI first, but traditional insurers now nip at their heels. Berkshire Hathaway integrated AI analytics products from CLARA. Allianz Trade uses machine learning to predict bankruptcy risks. AXA Switzerland is building out a stronger analytics function using Google Cloud Platform (GCP) instead of an on-premises system.

AI is no longer the future tool in insurance; it’s a key element of present-day business models and new service lines.

Expanding Role of Digital Sales Channels

Insurtech companies gained a strong and evolving market position by offering better digital customer experience (CX). Consumers distrust insurers and are deterred by the lack of information. A J.D. Power CX Study found that customer satisfaction scores are lowest when they can't find info on the insurer’s website or app and have to call the insurer, which happens 42% of the time.

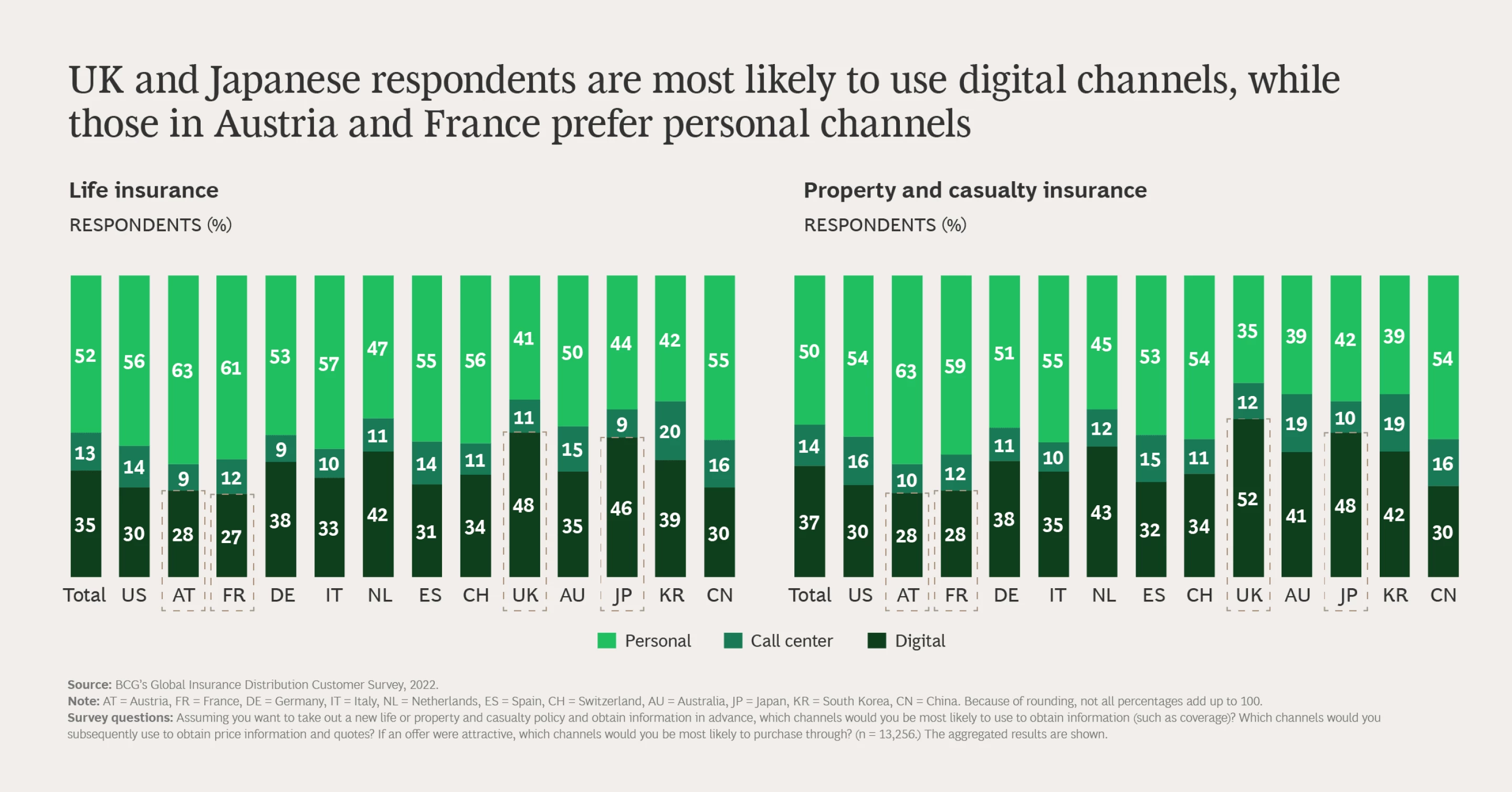

In 2020, only 5% of insurers used websites to engage with prospects, but 49% of consumers marked this channel as “important.” In 2023, a third of insurance consumers preferred researching and comparing quotes online rather than interacting with an agent. However, there are some regional differences.

Source: BCG

As Millennials and Gen Z become the dominant consumer group, insurers will need to enhance their omnichannel capabilities for consistent and speedy replies across multiple touchpoints.

Forrester estimated that most tech spending this year will focus on improving CX, growing revenue, and reducing costs. This means developing better self-service solutions for customer inquiries and customer analytics tools.

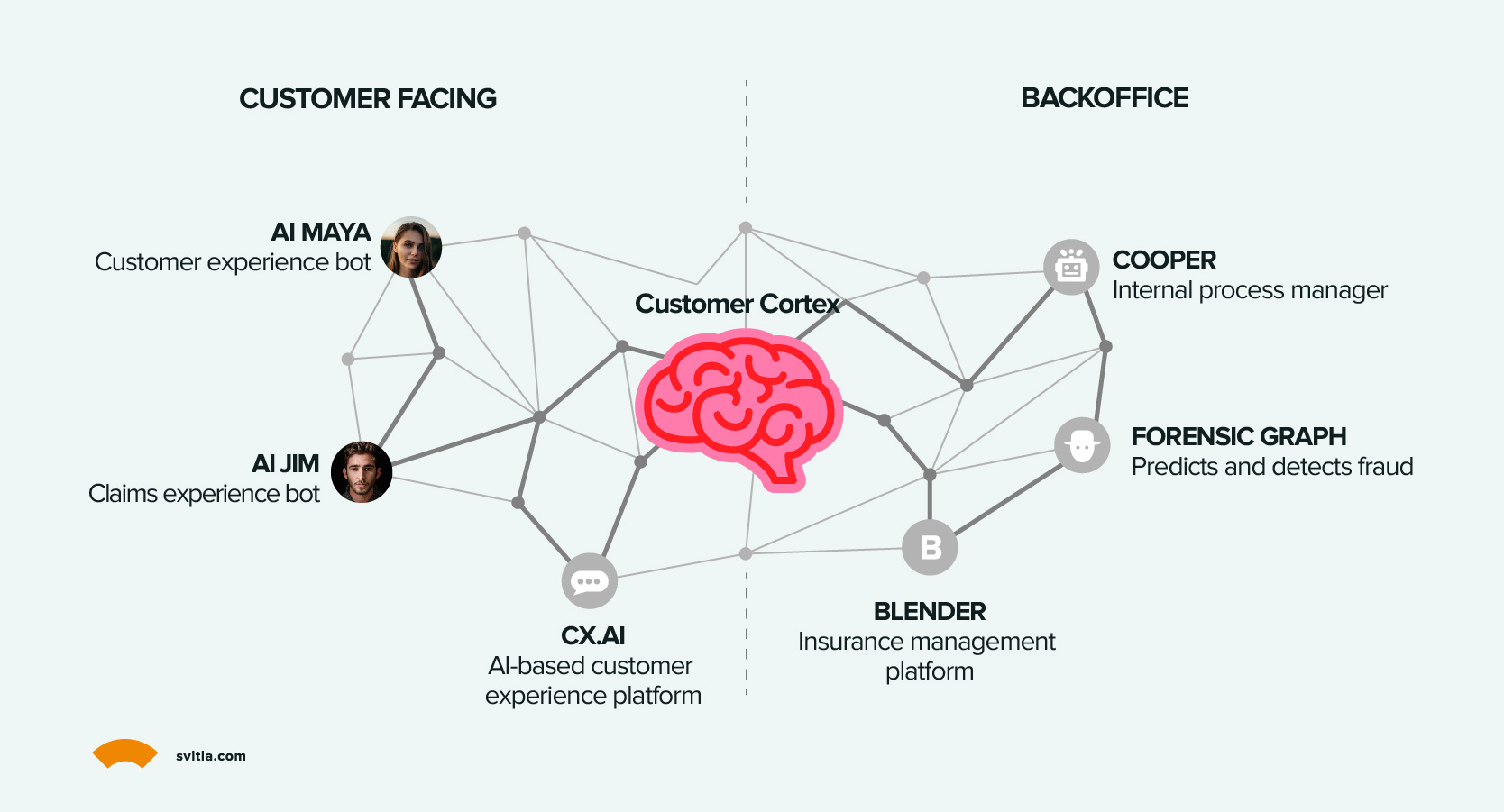

OP Financial Group successfully processes over 350,000 inquiries with an AI-powered virtual assistant. Using NLP technology from IBM, the agent can answer 9 out of 10 questions and automate 7 out of 10 tasks without human intervention. The chatbot helps customers resolve issues faster, leading to higher satisfaction and shorter waiting times to speak to agents for complex cases.

Customers, agents, and brokers benefit from digitally enabled insurance distribution. Customers get tailored information and services. Agents and brokers get better tools to engage, educate, and convert prospects across channels and generate more business — then feed data back. A pan-Asian insurer optimized its customer journey by using advanced analytics on its partner data set. By delivering more personalized messages via digital channels and elevating customer experience, the company increased campaign cycle times by 2-4X and increased policy quote volume by 56%.

Embedded Insurance Products

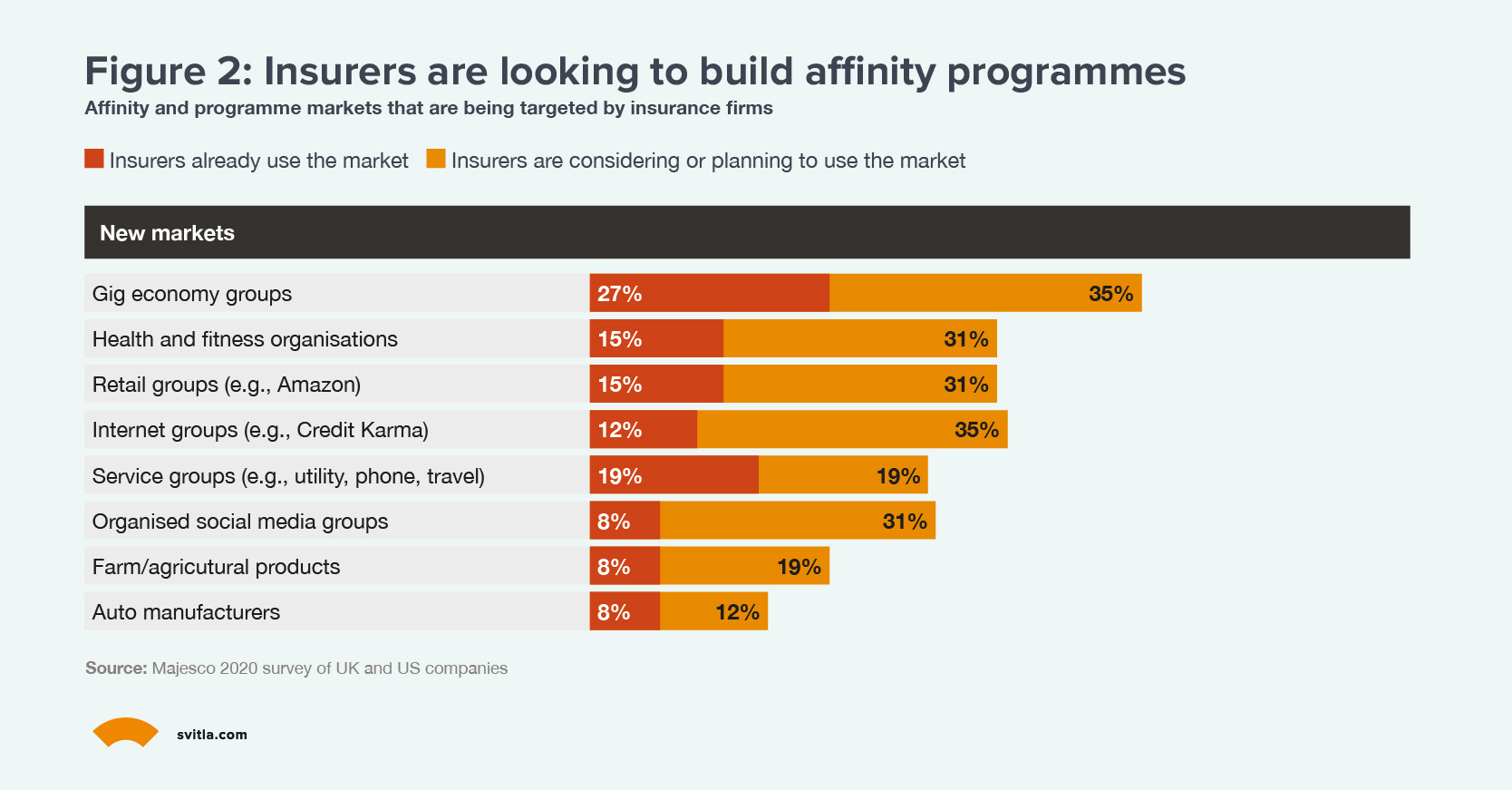

Digital insurance leaders aim to enhance their owned digital channels and expand their digital distribution footprint with third parties, according to PwC. This includes the potential of distributing embedded insurance products by a non-insurance entity.

Source: PwC

Embedded insurance distribution means upselling products through partners’ digital interfaces at a convenient time. For example, an online shopper gets offered an extended warranty on their laptop or a wearable device company offers lower health insurance premiums to its most active users.

Traditional insurers shoulder substantial distribution costs that often make up to 50% of total industry costs. Direct insurers, relying less on in-person selling, have 70% lower operating cost ratios than multichannel insurers.

Embedded insurance combines direct selling and economies of scale, allowing you to add direct distribution channels at minimal cost. Allianz Partners became an embedded insurance partner for Jaguar Land Rover and signed a strategic partnership with Insurtech player bolttech to provide embedded device and appliance protection insurance across Asia Pacific and the United States.

Zurich Insurance Group launched Zurich Edge – a collection of embedded tools for quoting, policy purchases, servicing, and claims management. The company has over 200 partnerships with companies in retail, travel, banking, FinTech, automotive, and telecom industries.

By 2028, up to 30% of insurance transactions may occur through embedded channels, according to EY. The list of distribution partners is growing. Medical device manufacturers, life science firms, property management platforms, airlines, cruise lines, and micro-mobility companies are new market niches for insurers.

Generative AI Copilots for Insurance Agents

Generative AI tools are efficient workplace companions for various knowledge tasks: Policy information lookup, personalized discount generation, underwriting, claims assistance, etc.

Using fine-tuning techniques like retrieval augmented generation (RAG), open-source foundation models like GPT-4 or BERT, can be privately trained on corporate data. For example, models, trained on customer support documents, can provide contextually relevant responses or current underwriting policies to assist risk evaluation. AXA recently launched an internal Secure GPT assistant to help its workforce generate, summarize, translate, and correct texts, images, and codes.

British Insurtech company Send introduced a proprietary Smart Submission platform for underwriting data management. The gen AI assistant can extract required information from unstructured data submissions to speed processing and provide smart submission routing.

When properly trained and secured, Gen AI models can increase the productivity of human agents, taking over menial tasks and allowing them to focus on exceptional customer service.

Insurtech Software Development Challenges

While companies are ambitious about Insurtech development, many also get deterred by insurance industry challenges: Complex regulatory landscape, legacy infrastructure, missing digital capabilities, and privacy concerns.

Regulatory Compliance

Companies looking to enter the B2C Insurtech segment have to prepare for heavy regulations around solvency, market conduct, and review and rule on requests for rate increases for coverage, among other factors. The regulations vary a lot by jurisdiction. The common route to overcome this is via re-insurance partnerships with tier-one carriers.

Insurance technology services providers face fewer operational compliance requirements but often struggle with missing technology regulations. Lack of AI regulatory guidance is seen as a barrier to successful innovation by 64% of insurance CEOs. Existing policies on risk assessment, underwriting, and investment management require a balance of tech know-how and knowledge of legal frameworks.

Technical Debt

Traditional insurers and their Insurtech development partners often face significant technical debt when launching new products. Nearly half of insurance leaders (46%), surveyed by DXC, agree that tech debt limits their growth, yet they aren’t pursuing fast elimination strategies due to risk aversion, cultural resistance, or lack of experience with modern software architectures.

Technical debt affects insurers in many ways. Data inefficiencies lead to incomplete business analytics and compliance issues. Outdated processes result in lost business opportunities, and retaining talent becomes harder as their frustration with technical systems grows.

Addressing technical debt can save insurance companies 39% in costs and help retire 37% of redundant applications, according to the same DXC report. An experienced Insurtech software development services provider likeSvitla Systems can ensure modernization efforts don’t disrupt core workflows or business operations, delivering incremental, sustained changes.

Missing Skill Sets

Insurance companies face workforce gaps, with over 400,000 positions at risk of staying vacant in the next decade. Tech skills gaps are particularly acute, with 64% of IT leaders naming talent shortages as the biggest barrier to adopting emerging technologies, ahead of implementation costs and security risks.

One common cloud adoption myth is that you can re-assign existing IT staff to support new cloud architectures (which is almost never the case). Big data analytics adoption requires data engineers, experienced in building high-load, scalable, and secure data pipelines and querying engines. Seeking external Insurtech development services makes the most sense.

Privacy Concerns

Machine learning and generative AI can bring a new degree of depth to analytics in the insurance industry. However, such models require ample data for training, which may include sensitive corporate information or personal consumer data. The collection, processing, storage, and sharing of customer data must comply with relevant data protection laws, permissions, and regulations.

Likewise, insurance companies must take sufficient measures to ensure air-tight system security, especially as AI-specific cyber-attack vectors emerge. Privacy-preserving techniques like homomorphic encryption (HE), differential privacy, secure multiparty computation (SMPC), and federated learning can be used to ensure data security and privacy.

Alternatively, you can use synthetic data – computer-generated datasets, closely mimicking real-world information structures – to train and fine-tune advanced analytics models without risking privacy breaches.

Conclusions

The Insurtech industry has just started coming of age. There are still plenty of unoccupied market segments, especially on the B2B infrastructure side, and underserved consumer demographics in B2C segments. The market is also gravitating towards collaboration, over competition, with larger insurers seeking out strategic partnerships with Insurtech enablers and channel distributors or direct investments in innovative projects.

Looking to enter the Insurtech market or expand your presence? Svitla Systems would be delighted to consult you on digital transformation and technical project implementation.