Digital transformation has become pivotal in the evolution of financial services. To stay competitive and meet customer needs, financial institutions must embrace digital strategies as technology continues to transform our lives.

In this article, we will explore the key areas where digital transformation can fuel business growth in the financial services sector.

Digital Transformation of Finance: The Challenges of Traditional Approaches

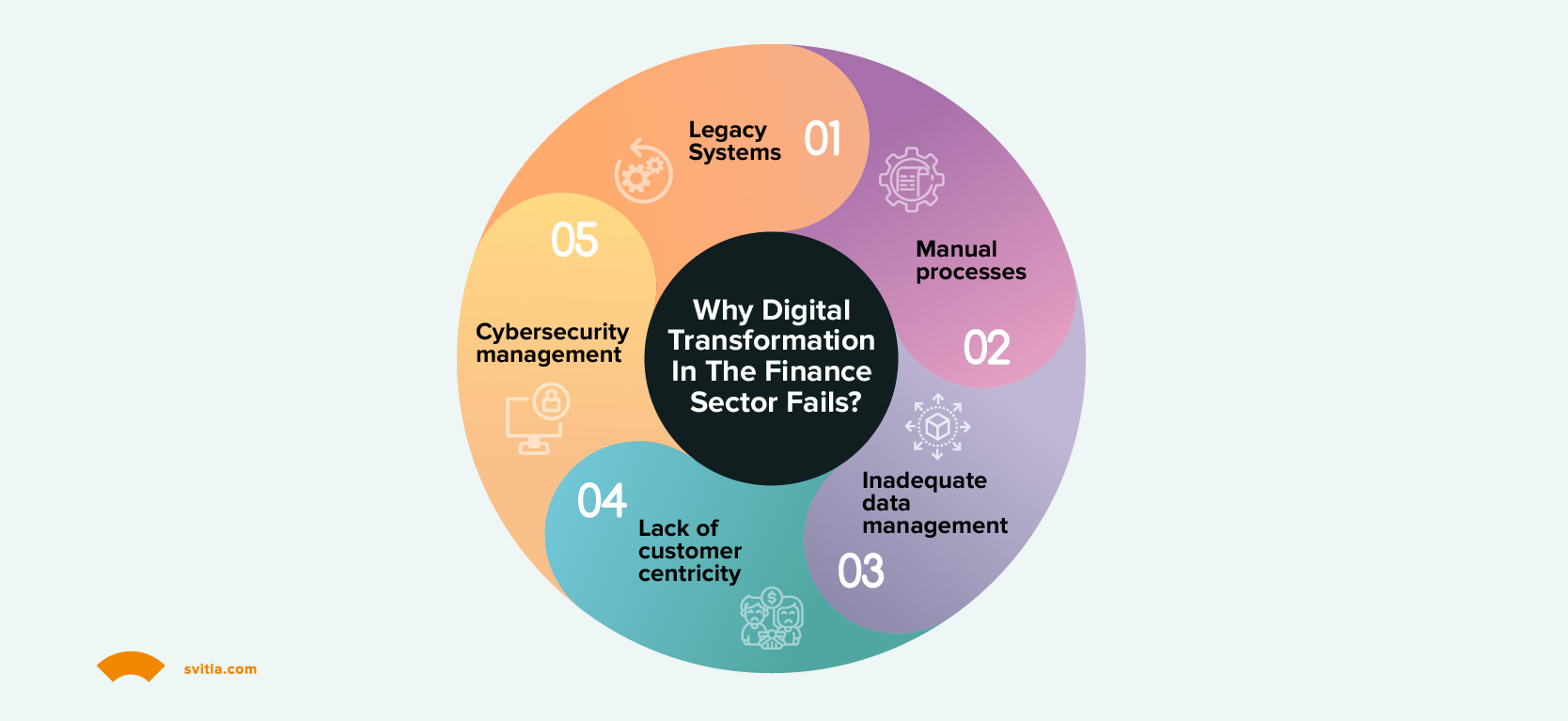

Although digital finance transformation is a no-brainer for most organizations, effectively executing it continues to be a formidable undertaking. In fact, merely 35% of endeavors focused on digital transformation achieve success. However, using traditional approaches in finance is no longer a solution; it’s a downright risk. In this section, we’ll explain the main challenges companies face when approaching finance traditionally.

1. Legacy Systems: The Achilles Heel of Digital Transformation in Finance

Many financial institutions still heavily rely on legacy systems that were built decades ago. These systems are often complex, inflexible, and lack the agility required to meet the demands of the modern digital era.

To illustrate, CRMa collaborated with Svitla Systems to transform their legacy software into a modern, cloud-based solution. Svitla successfully modernized CRMa's legacy software, migrating it to a scalable and secure cloud-based architecture, thus improving the performance, reliability, and accessibility of the software. Additionally, Svitla Systems introduced Agile development methodologies, allowing CRMa to benefit from iterative development cycles, frequent releases, and enhanced collaboration between the development team and stakeholders. This resulted in faster time-to-market and the ability to respond quickly to changing market demands.

2. Manual Processes: The Bottleneck of Digital Transformation in Financial Services

Traditional approaches often hinder digital transformation in finance and accounting as they notoriously rely on manual processes, which are time-consuming, error-prone, and costly. The simplification of manual processes is the primary focus for 70% of organizations.

Tasks like data entry, reconciliation, and compliance procedures can be streamlined and automated through modern technologies such as artificial intelligence (AI) and robotic process automation (RPA).

By embracing cloud-based solutions, organizations can scale their infrastructure and improve productivity. Automation and digitization of manual and repetitive tasks reduce errors and increase operational efficiency.

3. Missing Out on Insights

According to an IBM survey, 40% of respondents indicated that digital transformation contributes to the creation of more precise forecasts. 44% stated that it results in improved asset allocation, while 10% mentioned that it reduces structural costs.

Even though the finance industry deals with vast amounts of data on a daily basis, many institutions still struggle with siloed data sources, inconsistent data formats, and fragmented systems, which hinder effective data management.

4. Lack of Customer-Centricity: Failing to Meet Evolving Expectations

According to executives, the key benefits of digital transformation include enhanced operational efficiencies (40%), accelerated time to market (36%), and improved ability to meet customer expectations (35%).

It’s no secret that the finance industry is undergoing a paradigm shift where customers expect personalized, seamless, and digitally-driven experiences. Failing to adapt to these expectations puts financial institutions at risk of losing customers to more agile and customer-focused fintech competitors.

For instance, Svitla Systems recently partnered with InvoiceASAP to optimize their software, resulting in improved performance and faster response times. This enhancement resulted in greater user satisfaction and provided a seamless experience for customers. InvoiceASAP leveraged Svitla Systems' expertise in UX/UI to redesign their platform's interface. Additionally, Svitla helped InvoiceASAP take a customer-centric approach by adding new features and functionalities to their platform, allowing users to benefit from additional capabilities.

5. Cybersecurity Vulnerabilities: The Threat of Outdated Security Measures

Outdated security measures and inadequate cybersecurity practices put financial institutions and their customers at risk. Modernization involves implementing robust cybersecurity measures, leveraging technologies like blockchain, encryption, and AI-powered threat detection to safeguard sensitive data and protect against evolving cyber threats.

If financial institutions don’t invest in state-of-the-art security technologies, such as encryption, multi-factor authentication, and threat detection systems, to safeguard against cyber threats, it’ll become increasingly difficult to meet modern business demands and adhere to compliance with regulatory frameworks enforced by data privacy laws. Not to mention, a severe loss in customer credibility.

The Future of the Finance Digital Transformation

Many wonder why digital transformation is essential for business growth. The reality is that of the industries at the forefront of digital-first strategies, financial services at 93% represents one of the top industries undergoing this digital transformation. Thus, digital transformation, being a catalyst for change within the financial services industry, has become essential.

Between 2020 and 2030, the investment in direct digital transformation services is expected to experience a compound annual growth rate of 18%. As organizations integrate their existing strategies and investments into digital-at-scale future enterprises, the market is predicted to reach $7 trillion by 2023.

Now, let’s review some of the foreseeable trends of digital transformation in financial services.

Trend #1: Enhanced Operational Efficiency and Cost Savings

For 69% of decision makers, digital transformation is a primary driver to enhance process efficiency. By leveraging technologies, for example, robotic process automation, machine learning, and artificial intelligence, the digital transformation of financial services translates into the automation of repetitive tasks, improvement of accuracy, and the securement of significant time and cost savings.

Trend #2: AI and Automation

As indicated by McKinsey & Company, the insurance industry could automate around 25% of its operations by 2025, driven by the implementation of RPA technology. Chatbots, virtual assistants, and AI-driven algorithms provide customer service, fraud detection, risk assessment, and investment management, streamlining processes and enhancing customer experiences.

Trend #3: Open Banking and APIs

Approximately 97% of businesses that have embraced open banking acknowledge its contribution to their operations, particularly, enhancing customer service, engagement, capacity to offer new services, and creation of fresh revenue avenues. Open banking initiatives are gaining traction, requiring banks to share customer data with third-party providers through Application Programming Interfaces (APIs). This will lead to more personalized financial services, innovative offerings, and improved customer control over their financial data.

Trend #4: Digital Payments and Mobile Wallets

Cashless transactions are becoming the norm, with mobile wallets and digital payment platforms like Apple Pay, Google Pay, and PayPal gaining widespread adoption. According to PwC's "Payments 2025 & Beyond" report, cashless payment volumes are forecasted to nearly triple by the year 2030.

Trend #5: Cybersecurity and Privacy

Spotting fraud claims poses a significant challenge for financial firms. The combined expense attributed to fraud surpasses $40 billion annually. As digital transactions increase, the importance of robust cybersecurity and data privacy measures becomes paramount. Financial institutions must continuously invest in cybersecurity solutions to protect customer data and prevent breaches.

Trend #6: RegTech and Compliance

When thinking about the different areas that could potentially be impacted by regulatory changes over the next 5 years, over 48% of industry experts deemed regulation as the most concerning factor. Regulatory Technology (RegTech) solutions are being used to automate compliance processes, reducing manual efforts and ensuring adherence to complex regulations without compromising security.

Trend #7: Robo-Advisors

Robo-advisory platforms are automating investment management, offering algorithm-driven portfolio management and investment recommendations based on individual risk profiles and financial goals. Approximately 54% of investors acknowledge that due to market volatility caused by COVID-19, their confidence in utilizing robo-advisors has somewhat diminished, yet more than 67% of investors seek a digital experience that involves a hybrid engagement between a human advisor and a robo-advisor.

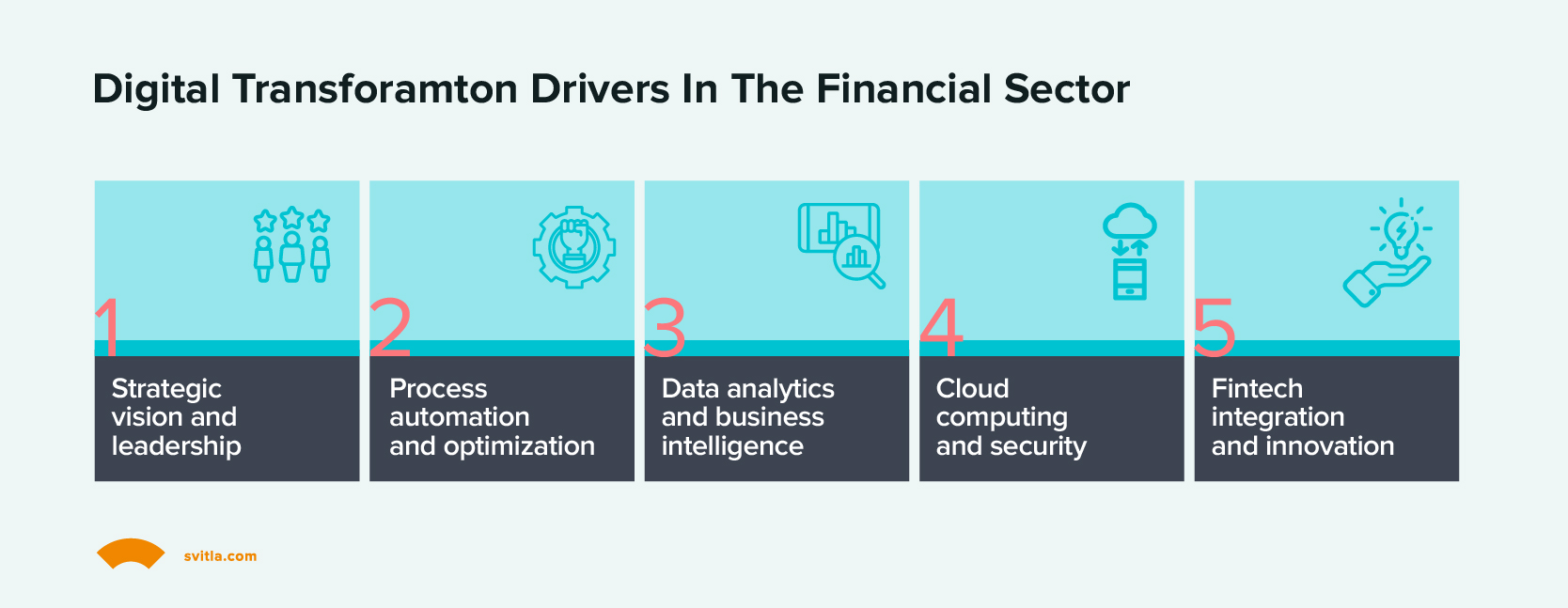

Success Elements of Digital Transformation in Finance

Next, we’ll give you a high-level overview of the multiple elements that drive success when embarking on digital transformation initiatives in finance.

Strategic vision and leadership. A clear digital transformation strategy is essential for success as it provides a roadmap for the organization to follow, aligning efforts and resources towards a common goal. Effective leadership sets the vision, fostering a culture of innovation, and mobilizing teams towards digital excellence.

Process automation and optimization. Automating financial processes has a significant impact on efficiency by reducing manual errors, increasing speed, and improving accuracy. Streamlining workflows and minimizing manual tasks not only saves time but also allows resources to be redirected towards more value-added activities.

Data analytics and business/decision intelligence. By harnessing the power of data analytics and business intelligence, organizations can unlock valuable insights that drive strategic initiatives. In addition, decision intelligence, which combines advanced analytics, artificial intelligence, and human expertise, enhances decision-making processes with predictive and prescriptive insights that guide strategic initiatives, risk management, and financial planning.

Cloud computing and security. Financial institutions must protect sensitive financial information, maintain trust, and mitigate the risks of data breaches or unauthorized access.

Fintech integration and innovation. By partnering with innovative fintech firms and embracing emerging technologies like AI and blockchain enables finance professionals to explore new possibilities, automate complex tasks, and drive innovation.

Accelerating the Digital Transformation of Finance with Svitla

Embracing digital transformation for financial services is no longer an option but a necessity to stay relevant and competitive in today's financial landscape. The truth is that digital transformation in finance is revolutionizing the industry, offering unprecedented opportunities for operational efficiency, customer experience, data insights, and innovation.

Svitla Systems can become your partner of choice to help you navigate the digital transformation of your financial projects and solutions:

Svitla Systems has over 20 years of experience in the IT industry, 1,000+ developers on board, over 5,000 completed projects, and 10 development centers worldwide.

Svitla has repeatedly received the ISO 9001:2005 certification, the SOC 2 audit, and is an AWS Advanced Tier Partner.

Svitla Systems has been included in the 2023 List of TOP 100 Global Outsourcing Companies by the International Association of Outsourcing Professionals (IAOP).

Among a vast number of clients who entrusted their projects to Svitla, there are well-known companies like Logitech, Global Citizen, Amplience, Ingenico, Ancestry, and Rainmaker Group.

Does your financial project need an expert tech partner? Team up with Svitla Systems and earn a strategic competitive advantage for your financial projects by working with the right team of specialized, highly-skilled experts.