The mobile banking momentum has been going since 2010, with the emergence of challengers like Moven, Simple, and GoBank in the US. Today, roughly 400 neobanks serve over 1 billion customers globally. Many early FinTech companies became unicorn startups (Revolut, Chime, Brex, N26), and some successfully IPOed (SoFi, Square).

Early market entrants quickly amassed customers with no/low-cost checking accounts, free debit cards, and low-cost money transfers, but more importantly, they offered superior user experience (UX).

In 2018, 68% of US online banking users were frustrated with their financial experience. In other regions, traditional banks didn’t prioritize online channels as much as in-branch interactions either.

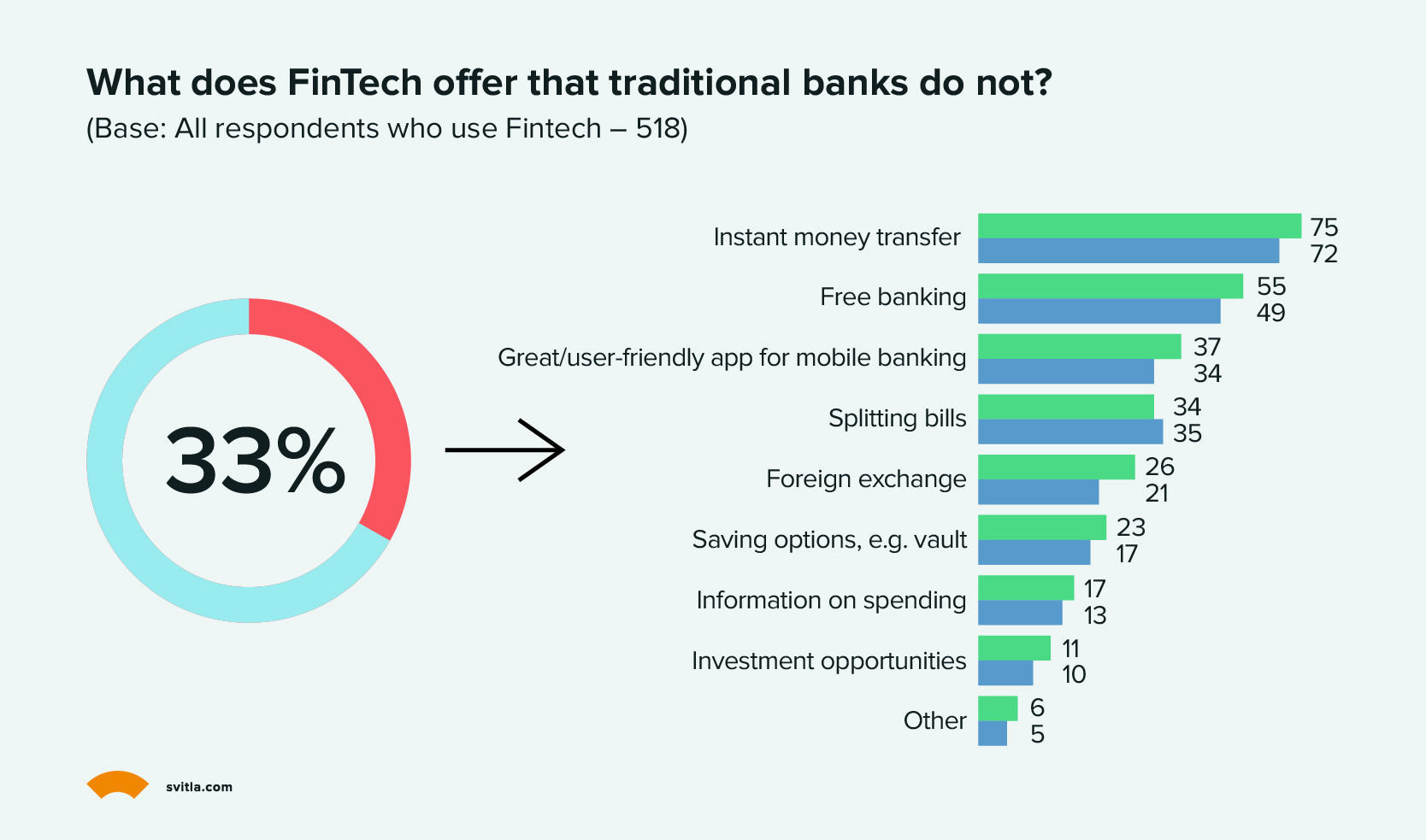

Challenger banks capitalized on frustrations, enticing users with a simple, sleek, and cheap money management experience – the very reasons why people prefer FinTech banks to incumbents up to this day. Let’s do a deeper dive into such FinTech value propositions:

Source: Irish Ministry for Finance

Traditional banks launched digital transformation efforts under the threat of losing market share and transactional revenues. Between 2015 and 2020, most retail banks focused on redesigning their web and mobile experiences, often partnering with FinTech companies to acquire missing technology capabilities.

This reshuffle produced good outcomes: Innovative digital tools for consumers, more attractive financial products fueled by analytics, and plenty of innovation in financial infrastructure.

Today, half of global consumers agree that banks offer a good digital experience. But they still want more. Nearly half say they couldn't borrow when needed, and 85% want more loans with digital or instant approval, per a Mastercard survey. Likewise, only 25% say their bank excels at staying aware of significant changes to their financial and personal situations.

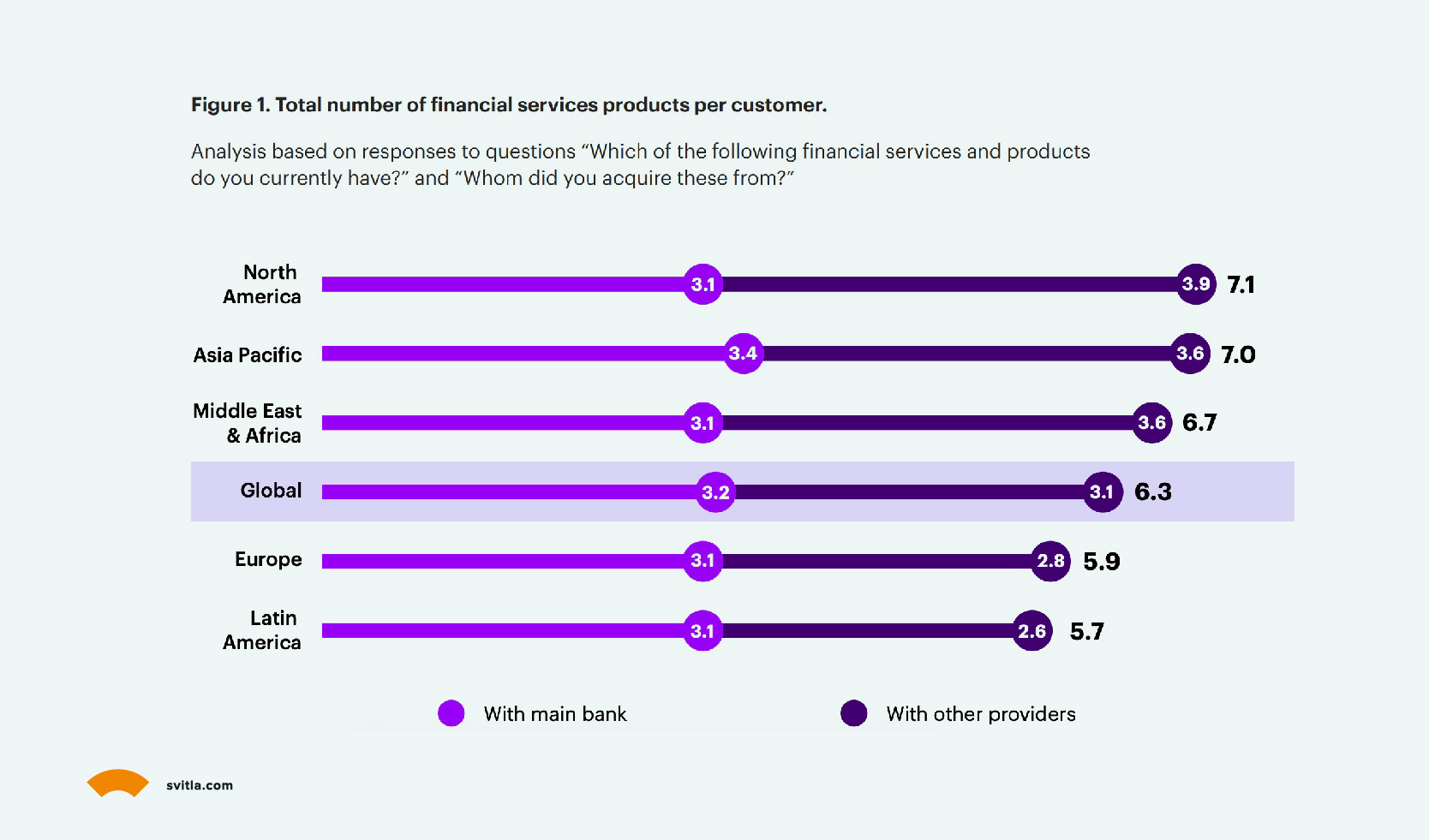

Substantial gaps persist in digital banking experiences. Where there are gaps, there are opportunities for new product development, especially as most customers use a portfolio of financial products from different banks and FinTech companies.

Source: Accenture

Key Features For a Banking Application

Whether you’re looking to launch a new financial product or scale an existing one, here are the features to consider in mobile banking application development.

Account Opening

A mobile banking app is a major customer acquisition channel. Done right, it can attract an abundance of new users, especially among younger demographics. Between 2023 and 2026, over 4 million US Gen Z consumers will open new accounts yearly, preferring mobile over other channels. That is, if banks improve their digital accounting opening processes.

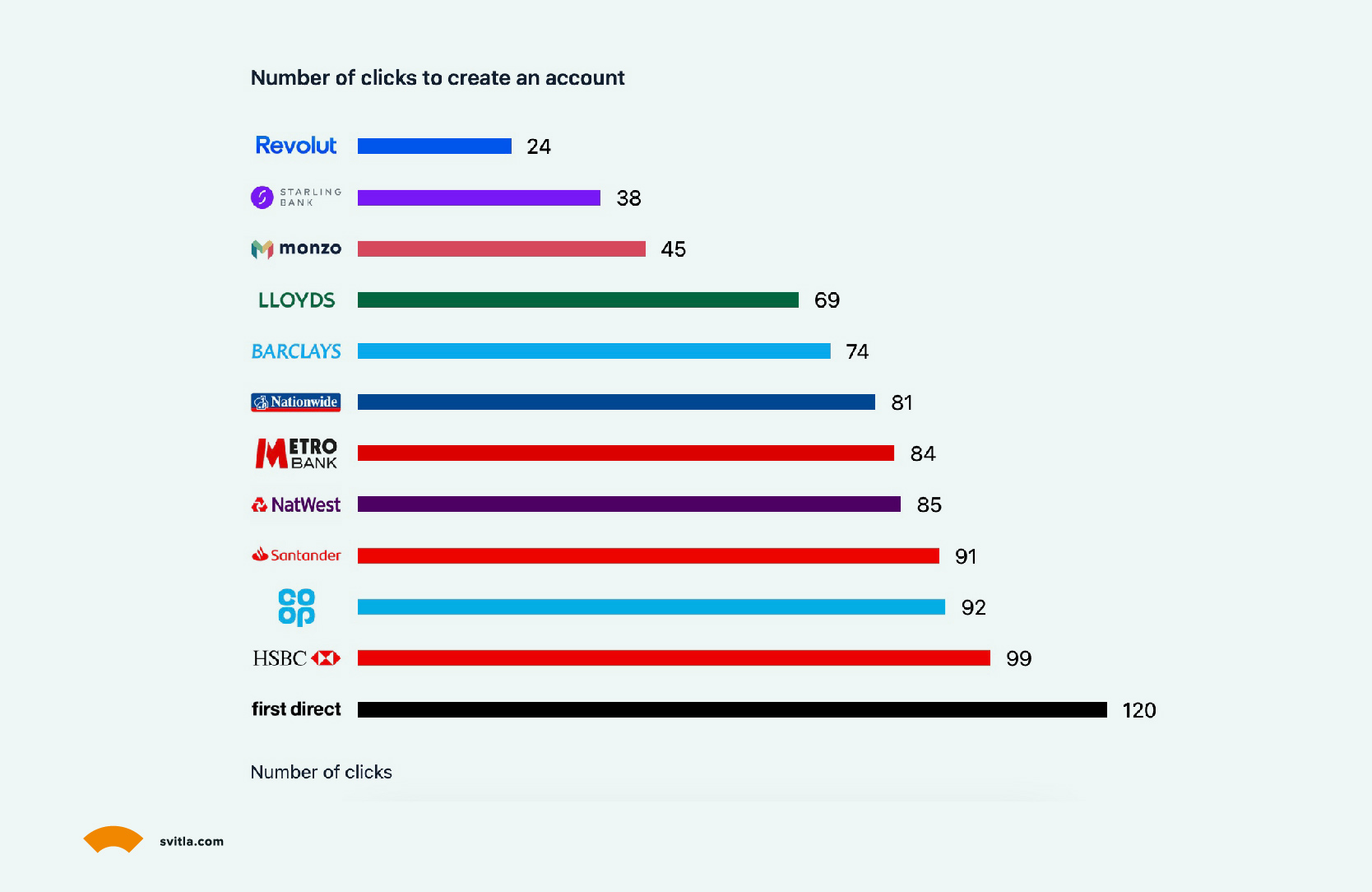

At present, 68% of consumers churn at onboarding due to perceived length or complexity. An effective account opening process should have minimal steps to collect the required information for customer-centric programs like Know Your Customer (KYC) and provide the user with immediate value. A significant part of the digital neobanks’ success was due to the fast account opening, instant ID verification, and account creation.

Source: Built for Mars

Our UX/UI team recommends minimizing the steps to activate an account to the bare minimum for KYC and requesting further customer information after customers have used their new account and want to unlock extra features (e.g., connecting another bank account, ordering a debit card, or starting investing).

Key features:

- Digital identity verification

- Instant checking account

- Account top-up options

- Debit/credit card ordering and activation

- Virtual debit card generation

- Access to Apple Pay/Google Pay

Money Deposit Features

The next onboarding step is persuading the user to deposit money with your bank. Ideally, you’d want to attract higher deposits and convince the users to make your bank their primary provider (i.e., one where they transfer their salary/other incomes and keep savings and investments).

The above is a big ask, so approach it progressively by revealing the different features and advantages of banking with you: full deposit protection, better interest rates, and a simple direct deposit experience.

According to a DTSVN survey, over 21% of consumers who opened a new checking account last year cited deposit safety as a critical factor. Almost 40% also cited the ability to set up direct deposit via mobile as an extremely valuable feature.

Key features:

- Online account top-up

- ATM/Branch locator

- Cash deposits

- Online check deposits

Account Management

Mobile banking apps are the most used method for account management, preferred by 48% of US customers and 53% of UK consumers. By 2026, over half of the UK population (28.5 million) will use mobile banking apps.

Convenient online account management features are crucial for engaging and retaining customers who no longer visit branches. They prefer to settle financial matters – from ordering a new credit card to managing transfers – on the go. An excellent mobile bank should enable that seamlessly.

Key features:

- Checking, saving, and multi-currency accounts

- Account balances and transaction history

- Card freeze, PIN change, report stolen

- Beneficiaries or payees' management

- No/low-fee fund transfers

- Recurring transfers and payments

Savings Features

A hefty amount of customer deposits improves liquidity and interest-based earnings. Traditional financial institutions have been slow to pass through higher interest rates to savers, with larger UK banks only passing through 28% of the base rate rise to consumers in 2023. This presents an opportunity for smaller institutions and digital challengers to capture new customer segments with high-interest rate accounts.

British challenger banks like Monzo, Revolut, and Starling offer rates of 3.25% or above compared to 0.9%-1.75% offered by HSBC, Natwest, Barclays, Lloyds and Nationwide. Not surprisingly, they are attracting more customer deposits. Monzo attracted 800,000 customers to open instant access savings in 6 months, while Atom Bank saw an 82% increase in its customer base between January and March 2023, City AM reported.

In the US, 82% of consumers keep their savings in a traditional or regular savings account, offering below 5% interest rates. For companies, offering high-yield savings accounts, these can be a great target for acquisition.

Key features:

- High-yield saving accounts

- Multi-currency saving accounts

- Money market accounts

- Savings pots or vaults

- Automatic interest on checking balance

Online Payments

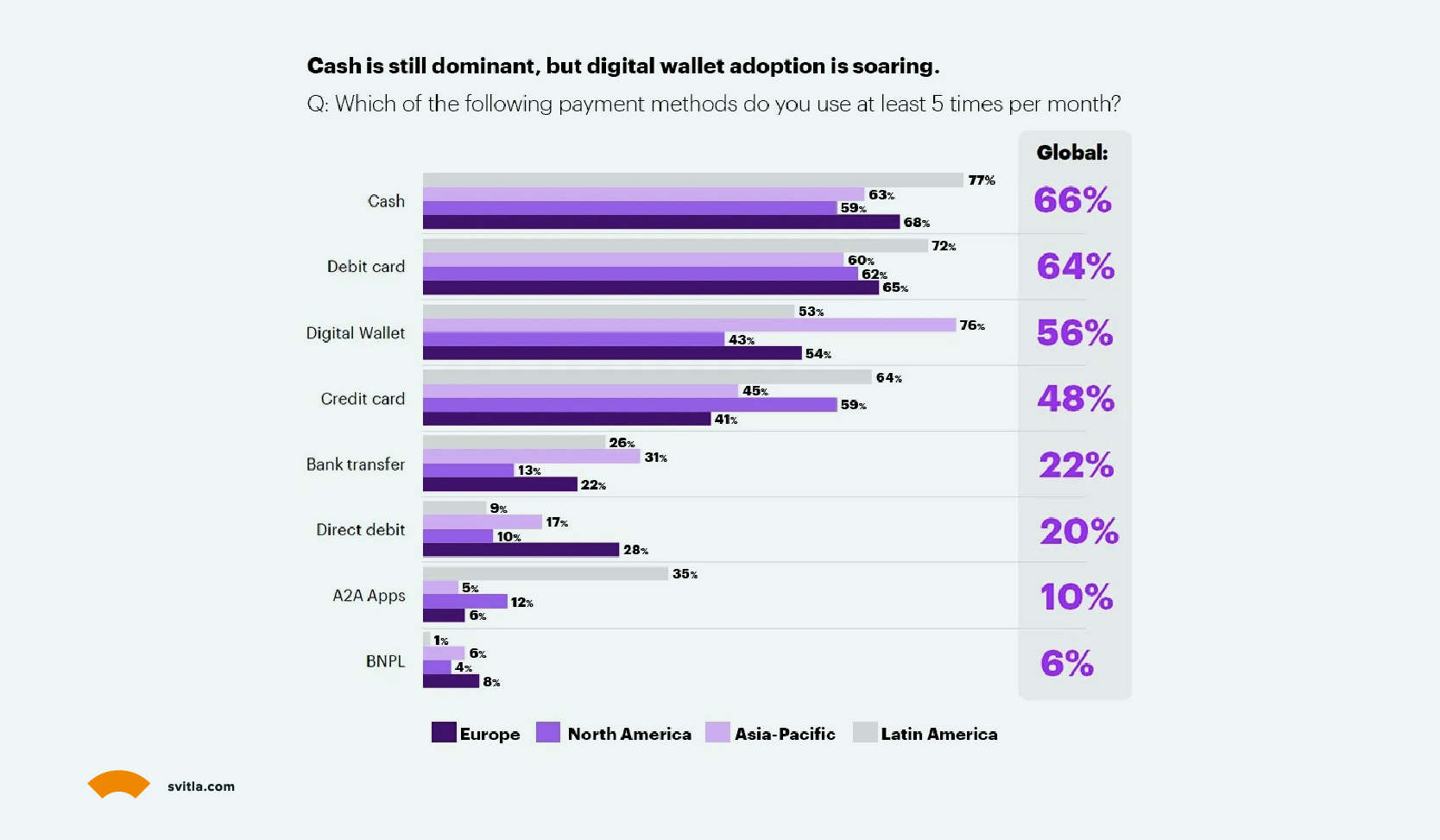

Online payments remain the fastest-growing market segment. Global cashless transaction volume is expected to reach 1.9 trillion by 2030, tripling compared to 2020. Digital wallet spending is expected to hit $10 trillion by 2025. Consumers prefer to pay online using various tools, such as QR payments, peer-to-peer transfers, and contactless mobile wallet payments, and banks must adapt to capitalize on transactional revenues.

Source: Accenture

Key features:

- Contactless payments

- Direct debit

- Instant bank transfers

- Split the bill

- eBill payments

- P2P payments

- QR payments

Personal Finance Management

Open Banking enabled financial institutions to securely access customers’ financial information using application programming interfaces (APIs). Effectively, users can aggregate data from multiple products – primary banks, investing apps, and online payment apps – to get a full view of their financial standing. For banks, account aggregation opens opportunities for the development of new personal finance management (PFM) tools to help customers build better money habits and grow their wealth.

FinTech platforms like Wealthfront, Betterment, and SoFi were the first to allow customers to consolidate their finances for a 360-degree view, a smart move for customer retention. Greater data access enables advanced financial data analytics, ranging from more accurate credit scoring and robo-investing to potentially fully autonomous finance.

A recent survey found that 38% of US consumers have unanswered financial management questions, and 43% are open to using generative AI to manage their finances. The idea of using AI for PFM is familiar. Advisors at Morgan Stanley have been relying on machine learning algorithms since 2018 to create personalized advice for clients. Popular PFM tools like Cleo and NerdWallet also trained private AI models to provide hyper-personalized advice.

Gen AI can add an attractive ‘conversational interface’ to PFM products, helping clients understand the standard analytics charts about their net worth, debt, and spending habits without contacting a human advisor.

Key features:

- Aggregated spending analytics

- Expense tracker with categories

- Financial goal setting

- Round up transactions and save the difference

- Early access to salary payments

- Debt management tools

- Net worth tracker

- Credit score monitoring

- Bills and subscription management

Credit and Lending

As inflation increases living costs, consumers are more likely to seek personal loans and flexible credit lines. In France, 48% took out one or more loans last year. In 2024, 27% of Americans plan to open a new credit card account. Globally, over 360 million consumers used a buy now, pay later (BNPL) service in 2022, with usage projected to increase by 157% by 2027.

To prevent losing lending revenues to FinTech firms like Klarna and Affirm, banks are launching in-house BNPL services. In 2023, U.S. Bank launched a consumer BNPL offer, and BNP Paribas released a service for corporates. Svitla Systems helped a US FinTech company develop an online micro-lending application that allows customers to easily obtain financing on demand.

Small business lending, in general, has been profitable for neo-banks. In the UK, challenge banks now account for 55% of all SME loans, impacting incumbent revenues. In emerging economies, online lending products have seen strong growth as consumers need help accessing traditional financing. Nubank provided over 5.7 million Brazilian consumers with credit access in one year, solidifying its market position. Indonesian digital banking unicorn Akulaku has over 7 million monthly active users, primarily due to low-cost credit and BNPL products.

Key features:

- Credit card ordering

- Buy now, pay later (BNPL)

- Personal loans

- Mortgage

- Car loans

Investing Tools

Similar to lending, consumers increasingly seek convenient, online retail investing tools. The percentage of clients using FinTech products to manage their wealth is expected to double from 9% to 18% by 2026, driven by low fees, easy switching, and better digital experience. SoFi, a company first specializing in student loans and later moved to wealth management, onboarded over 585,000 new customers in Q4 2023, bringing the user base to 7.5 million, up by 44% compared to 2022.

As Baby Boomers begin to transfer an estimated $50 trillion in wealth to Millennials, interest in better wealth management products will only increase. However, many Millennials need more knowledge and confidence to make informed choices. Traditional financial service providers don’t always provide the needed support, especially around new investment classes.

Key features:

- Investment portfolio management

- Low-fee security trading

- Access to fractional shares and asset ownership

- Robo-investing tools

- Cryptocurrency purchases

- Access to investment market data

- Private pension funds

Account Security

Due to increasing finance crime rates, mobile banking application development requires high security. According to the 2024 State of Fraud Benchmark Report, 56% of financial sector respondents lost over $500K in a year, and 25% lost over $1 million. Authorized push payment (APP) fraud is the most common type globally, followed by bust-out fraud and account takeover fraud.

In response, financial companies are leveling up their cyber-defences, particularly in mobile banking. Almost half of the banks now use features like phone-centric verification and selfie or liveness tests. Biometrics-based authentication is another popular approach, used as an alternative to passwords and PINs.

Banks are also implementing more sophisticated fraud detection systems on the backend, powered by machine learning and Gen AI. Revolut launched a new card scam detection feature powered by machine learning and saw a 30% drop in fraud losses due to investment scams involving P2P transfers.

Key features:

- Biometric and two-factor authentication

- Instant alerts for suspicious transactions

- Automatic card freezing after unauthorized charges

- User device recognition and authorization

- Strong data encryption

- Automatic transaction monitoring

- Remove device lock and wipe

Accessibility Features

Lastly, let’s not forget about inclusivity. Over 2.2 billion people globally have vision impairments, and more live with other disabilities and need adaptive mobile banking products.

Families and caregivers of people with disabilities represent a $8 trillion consumer market yet remain a commonly overlooked group. They often face challenges in performing even the simplest operations like checking their account balance. Building an inclusive mobile banking app helps vulnerable consumers feel more welcomed, empowered, and content.

Key features:

- Voice command support

- Screen reader compatibility

- Text resizing options and font adjustment

- Support of alternative input methods

- Audio and video alerts

- Accessible error handling

How to Build a Mobile Banking App: Recommended Tech Stack

Mobile banking apps need to combine robust scalability and security with an attractive user-front end.

Here at Svitla Systems, we have first-hand experience in this area and recommended technology stack. To deliver a superior user experience and benefit from phone-native features like camera, biometric sensors, and location-based services, our mobile application development team recommends native application development.

On an architecture level, microservices are better than monolith or service-oriented architecture as they promote domain-driven design (DDD). DDD organizes services around product capabilities (e.g., account opening, online payments, analytics) rather than technical characteristics. This approach eases scaling from a minimal viable product (MVP) to a full-feature product without risking performance issues due to hidden dependencies.

Mobile banking applications also require robust data infrastructure to support various big data analytics use cases — from baseline transactional analytics to predictive customer insights and automated action recommendations.

Specifically, you’ll need to decide on the optimal tech stack for big data storage and analytics, then set up secure data pipelines for rapid data collection, transformation, and uploads to a data warehouse or data lake. Our Big Data analytics team can advise you on this.

Challenges of Mobile Application Development for Banking

Mobile banking is a growing market with plenty of untapped revenue opportunities. However, finance is a highly regulated industry in terms of operational practices and technology.

On the tech side, banking as a service (BaaS) providers have reduced the entry barrier for new players, offering API-based access to core banking products for account management, payment processing, lending, and more. They also supply new banks with KYC, AML, CTF and risk management technology.

Still, product owners should pay attention to other potential pitfalls:

- Application security. Mobile banking apps need a streamlined account opening process, but usability shouldn’t compromise security. Use modern KYC approaches like online identity document scanning using OCR, selfie or liveness tests, and biometrics for transaction authorization. Leading digital banks use a risk-based approach (RBA) to KYC and online security and adjust controls using custom risk matrices for different actions and customer profiles.

- Integration with legacy systems. Banks looking to expand their digital capabilities are often held back by legacy core banking systems. Many of these, designed decades ago, weren’t designed to handle large transaction volumes in real time. Integrating them with newer tech stacks is also a challenge since you’re never certain which interoperability or security issues may arise. The most sustainable approach to modernizing legacy banking software is progressive decoupling and unbundling business functionality from the legacy core and re-designing these as microservices.

- Secure data management. Digital banks need robust data analytics for advanced features like automated lending or investing. This requires a centralized system to aggregate data from different business systems (CRMs, legacy systems, web and mobile apps) and store it in a centralized data repository (a data lake or a data warehouse). Unifying data gives banks a 360-degree view of their customers and facilitates data auditability and regulatory compliance.

Final Thoughts

Banking services are crucial for consumers, but how much of that value chain can you capture?

Few consumers bank with a single institution. Instead, they use multiple traditional banks and pure-play digital players, creating opportunities for smaller players to gain market share from incumbents with lagging digital experiences. Savvy consumers also demand a holistic proposition of credit, debit cards, mortgages and other products, forcing banks to continue modernizing their array of digital financial services. These are exciting times for developing digital banking applications, especially as new technologies such as generative AI and quantum computing come to the fore.

Navigate the financial technology market confidently with Svitla Systems. Our cross-functional teams have successfully supported digital transformation efforts at retail banks and helped new market entrants with mobile solutions development. Contact us to learn more about our services.